- TradeWithTitans Newsletter

- Posts

- Forecasts, Forecasts, Forecasts

Forecasts, Forecasts, Forecasts

What to expect for the rest of this week

Forecast Nailed: Last Week in Review

Traders,

Sometimes markets throw curveballs. Sometimes they hand us exactly what we planned for. Last week was the latter.

If you attended our Sunday prep session, you saw our quant team's distribution forecast clearly outline a bullish scenario—a "right shoulder" move higher, targeting an upper bound around 5675-5743. Take another look at how perfectly this played out:

The price action didn't just follow our distribution—it traced it almost to the tick. We saw the lower bound tested early in the week at 5450, just 20 points shy of the lower end of our expected range. After that, the market powered higher, eventually touching and even slightly surpassing our upside target with an actual high of 5705

Clean, precise, and actionable—exactly what good forecasting is all about.

This Week’s Forecast: Expecting a Balancing Act

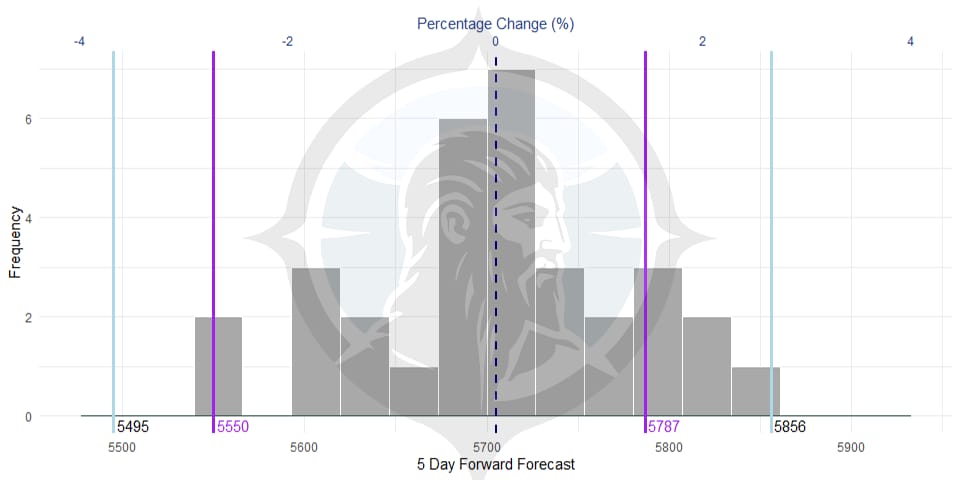

Now, what about this week? Our quants have crunched the numbers, and the story they're telling now is different, but just as clear: it’s all about balance.

Check the distribution forecast below. That large peak right in the middle indicates a high probability of range-bound price action. Simply put, the market is telling us it’s comfortable right where it is, at least for the short term. Violent breakouts aren't expected, but neither is a quiet drift. Instead, anticipate volatility within clear boundaries.

Here's what we're looking at:

Lower boundary: The week's low currently stands at 5596, perfectly aligning with the bottom of our forecast.

Upper boundary: We're seeing clear overhead resistance around 5700 level, where the distribution starts to taper.

Expected Close: Our models strongly favor a close near 5705, reinforcing this week's theme of controlled range trading.

In short, the market wants to pause, rotate, and find equilibrium.

Looking Ahead: Don't Miss Sunday

Last week, those who showed up Sunday walked away with clarity, precision, and a week of straightforward trading. If you’re looking for more of that same actionable insight, don’t miss the next prep session. We'll break down every key level, discuss the nuances behind this balanced market, and get you fully prepared to trade with conviction.

Until then, keep your expectations clear, your trades tight, and your eyes on the edges.

See you Sunday.

Want More of My Analysis?

Ready to call highs and lows with surgical precision instead of blindly YOLOing trades? Stop half-assing your trading and level up with Premium.

Live trading on voice: Hear me read the tape live — no hindsight BS.

Adam Set's Journal: Raw, unfiltered, pure alpha on every trade.

Order flow & volatility bots (and the new ETH Bot): Because manual scalping at 4 AM sucks.

Daily Plans: Know key reversals BEFORE they slap.

Educational resources: No fluff. Just actionable knowledge like DOM mastery.

We’re temporarily closed to new premium sign-ups to ensure everyone gets serious attention. Good news: our waitlist is open. Fill out a quick survey. We don’t care about your account size, just that you’re hungry and eager to crush it.

Please make sure your responses are thoughtful. If you pass our vibe check, we'll hit you up when a spot opens. Link stays active for 48 hours, so stay alert.

Can’t Wait?

If you’re itching for at least some alpha, hop into our free Discord. You’ll get Adam’s Chartbook, a risk management guide, and occasional real-time insights. Every so often, I’ll even drop a live call if I’m feeling generous—just don’t expect the full sauce for free.

Any questions? Hit reply. Unlike other guys who ghost, I actually answer and enjoy talking shop.

Catch you next week,

Jay