- TradeWithTitans Newsletter

- Posts

- Ghosts, Powell, and a Market That Won’t Commit

Ghosts, Powell, and a Market That Won’t Commit

A short week, big swings, and why we’re playing it cool near 5250.

Traders,

The easy trades are behind us. If you’ve been riding with me, you already caught the low, booked the squeeze, and — hopefully — slipped into a well-deserved coin coma. But now? The tape’s changing. And it’s subtle.

We’re starting to see signs that something might be brewing beneath the surface — not full-on alarm bells, but enough friction that I’m watching closely. The same folks who missed the move up are now screaming “buy the dip,” but I’m not so sure we’re in that phase anymore.

This isn’t about being bearish. It’s about being sharp when the market starts acting weird. And right now, it’s acting weird.

Let’s break down what’s happening — and why caution might be the move.

Powell’s Speech: Calm Voice, Loud Signal

If you didn’t catch Powell’s speech today — that’s fine, the market did it for you.

On the surface, it was textbook Jay: steady delivery, nods to the dual mandate, and even a light Ferris Bueller joke to keep the Chicago crowd happy. But make no mistake — the message underneath? It hit harder than it sounded.

Powell laid out a scenario that nobody really wanted to hear: tariffs could boost inflation, growth could slow, and the Fed has no intention of stepping in unless they absolutely have to. Translation? The inflation problem might not be over, and the rate cut fantasy is fading fast.

Tariffs… could lead to higher inflation and at the same time slower growth and weaker employment.

We are well positioned to wait for greater clarity.

That combo — inflation risk without policy support — is not a recipe for market comfort.

You could feel it in the tape.

S&P 500 closed down 2.2%

Nasdaq bled 3.2%

Bonds ripped higher

Dollar softened

And it wasn’t just price — I’m hearing PMs and analysts lit up with concerns about stagflation, Fed paralysis, and what happens if Powell’s “wait-and-see” turns into “wait-too-long.”

Not to mention that the behavior of the market — especially under the hood — feels familiar in all the wrong ways.

My quants and I couldn’t help but notice how closely this moment is tracking with what we saw in mid-March. Back then, we also saw a sharp implied volatility crush — with intraday action that turned dull, muted, almost eerily quiet. It felt like calm. But it wasn’t. It was compression.

Look at this chart — a VIX vs SPX overlay. Rudimentary but useful. Mid-march is highlighted in red, and you’ll notice how similar the recent action looks. The VIX steadily dropped as SPX held in a large but modest range… then the floor gave out.

What adds to the complexity right now is the inflation picture. Powell spent a good chunk of his speech trying to strike a balance: yes, inflation is lower than it was, but no, it’s not back to where they want it. And when you throw in tariffs on top of that, it gets murky fast.

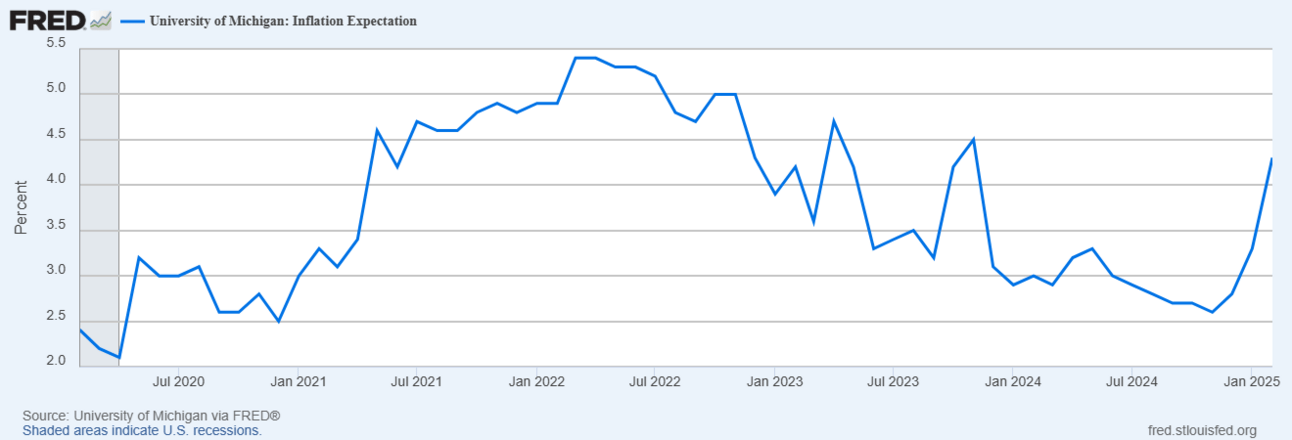

Just look at the University of Michigan’s Inflation Expectation data. After trending down for most of 2023 and early 2024, expectations are now rising — fast. That spike into 2025 tells you exactly what the Fed is worried about. Inflation might be coming back before it’s fully under control.

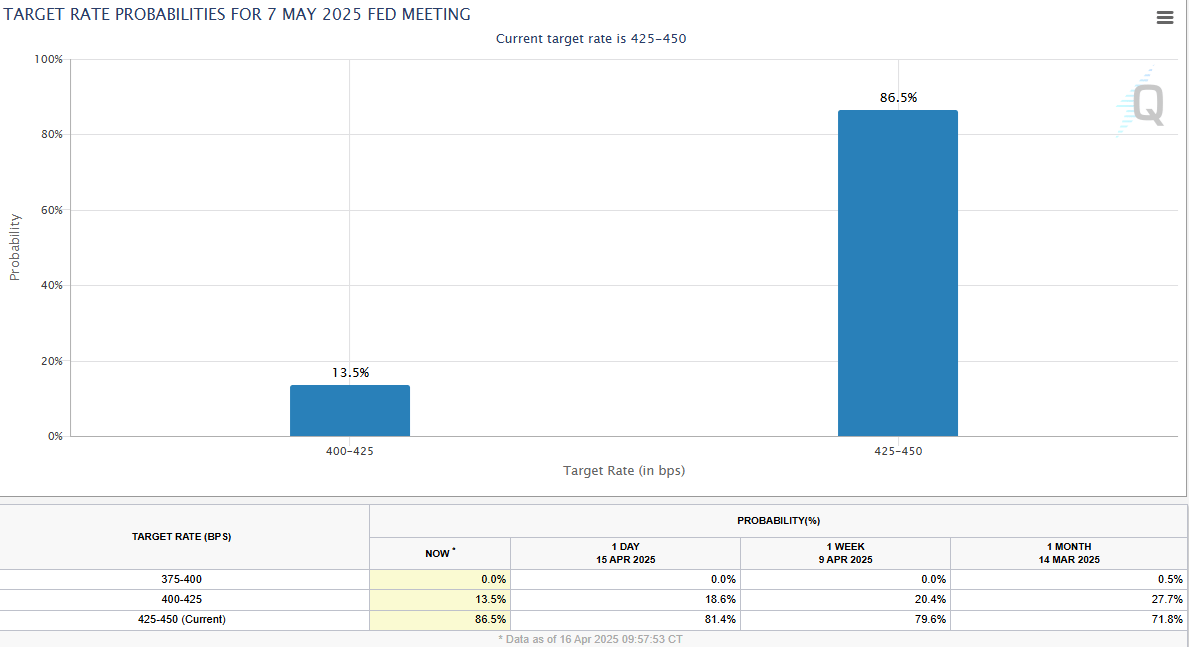

The Fed Funds Futures curve has been telling the story in slow motion. One month ago, markets priced in a 27% chance of a 25bps cut at the May 7th meeting. Last week? 20.4%. Yesterday? 18.6%. And today? Just 13.5%. Not gone entirely — but fading. That little bit of hope? It's leaking.

This slow erosion of optimism — on top of Powell’s caution, the inflation uptick, and the tariff overhang — creates a tough backdrop for risk assets. Especially if we continue to see markets drift without follow-through. That’s where range-bound price action turns dangerous. Not because it screams “breakdown,” but because it lulls traders into complacency.

So where does that leave us?

Honestly? On edge. There’s no flashing red light saying “short everything,” but there’s enough smoke to warrant caution. It doesn’t feel like the market is positioned for upside surprise anymore — it feels like it’s waiting to see who blinks first.

If this all sounds familiar — that’s because it is. The question now isn’t whether we repeat March. It’s whether the setup has changed enough to prevent it.

I don’t have that answer yet. But I do know this: when Powell gets more cautious, and the market gets more confident, that’s usually not a great mix.

Let’s talk about how I’m planning to trade around that next.

What’s Next: Stay Sharp, Stay Disciplined

Look — there’s no denying the market’s been acting a little weird. But before we spiral into full doomsday mode, let’s zoom out for a second.

Today wasn’t just a Powell-driven selloff. It was also vixperation, OPEX, and the start of a holiday-shortened week. That’s a whole cocktail of noise and forced flows — and when that’s the backdrop, sometimes price action can lie. We've all seen ghosts in this kind of tape before.

That’s why I’m urging caution, not panic. Yes, there are cracks showing. But this could just as easily be a positioning reset before the next leg higher. The market's not always out to kill you — sometimes it's just taking a breather and shaking the tree before a fresh move.

So what do we do?

Same thing we always do: show up with a plan and wait for confirmation.

Here’s how I’m approaching the next few sessions:

Pivot: 5250 — that’s the line in the sand. Above, we reassess risk-on. Below, we stay cautious.

Upside levels: 5305 → 5410.

Downside levels: 5185 → 5050.

We’re not trying to front-run a breakout or force a breakdown. We're keeping it simple. Letting the market prove it wants to trend again before we lean in. No need to play hero here — discipline is the edge.

So yeah — this week raised some questions. But it didn’t give us answers. Not yet. We’re staying nimble, staying patient, and letting price show us what’s real and what’s just OPEX noise.

Until then — if you celebrate, Happy Easter. And if not, enjoy the long weekend anyway. Lord knows this market gave us enough drama to think about during a three-day break.

Rest up. We’re back in the arena soon.

Want More of My Analysis?

Ready to call highs and lows with surgical precision instead of blindly YOLOing trades? Stop half-assing your trading and level up with Premium.

Live trading on voice: Hear me read the tape live — no hindsight BS.

Adam Set's Journal: Raw, unfiltered, pure alpha on every trade.

Order flow & volatility bots (and the new ETH Bot): Because manual scalping at 4 AM sucks.

Daily Plans: Know key reversals BEFORE they slap.

Educational resources: No fluff. Just actionable knowledge like DOM mastery.

We’re temporarily closed to new premium sign-ups to ensure everyone gets serious attention. Good news: our waitlist is open. Fill out a quick survey. We don’t care about your account size, just that you’re hungry and eager to crush it.

Please make sure your responses are thoughtful. If you pass our vibe check, we'll hit you up when a spot opens. Link stays active for 48 hours, so stay alert.

Can’t Wait?

If you’re itching for at least some alpha, hop into our free Discord. You’ll get Adam’s Chartbook, a risk management guide, and occasional real-time insights. Every so often, I’ll even drop a live call if I’m feeling generous—just don’t expect the full sauce for free.

Any questions? Hit reply. Unlike other guys who ghost, I actually answer and enjoy talking shop.

Catch you next week,

Jay