- TradeWithTitans Newsletter

- Posts

- How I Adjust My Levels in Real Time

How I Adjust My Levels in Real Time

Plus, See What Stock We Bought When Nobody Else Was Looking

Traders,

You know that smug sense of certainty you get right before the market stomps all over your “perfect” plan? Yeah, me too. I sent out the last newsletter, feeling all warm and fuzzy about my levels — then CPI hit, and suddenly ETH sellers came out swinging like they had an agenda to ruin your day.

Was my plan invalidated? In one sense, yes — some levels got shredded in the volatility. But that’s exactly why I always say you need to adapt in real time or get eaten alive. If you walk into the market like you know it all, well, the market’s about to hand you a tall glass of humility.

So how do we stay agile without becoming emotional lunatics? Let’s talk:

How to Adapt Your Plan

Some of you read that headline and are about to roll your eyes. “You’re just gonna say, look at the DOM, Jay.” Yeah, I am. But the real message is: don’t be that stubborn moron who keeps trying to short an uptrend or buy a meltdown just because your old plan said so.

High volatility is basically the market’s way of saying, “All you idiots think you know something? Let’s see how well you handle a liquidity vacuum.” Sellers flood in, buyers yank their orders, and next thing you know, you’re selling bottoms or chasing tops because you can’t admit your plan needs an update. The big players love that.

But instead of babbling on, let me give you two concrete examples from this week about how I adjusted my last plan in real time - with receipts of course.

Options

Wednesday: CPI triggered a big flush, but the second we reclaimed my pivot, I smelled BS. (Pro tip: If your pivot is retaken quickly, that’s a massive clue the initial move might be fading.) I decided to go bullish—but how do I not get whipsawed in the chaos?

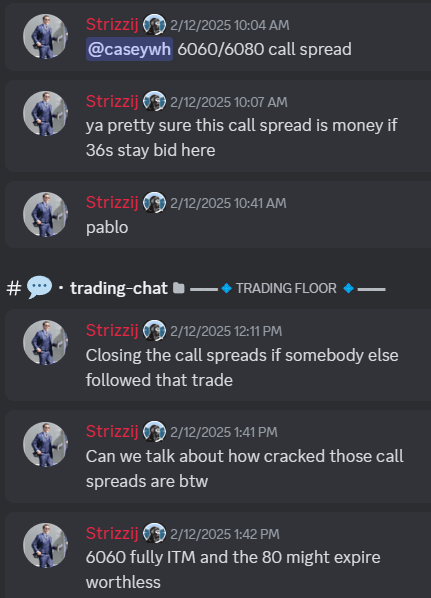

Enter the TWT quant team with a sweet trick: narrow call debit spreads. Why narrow? Because broader spreads can get hammered by volatility and time decay. A narrower width keeps things simpler. I chose the 6060–6080 call spread.

Sure enough, the market settled just under 6080 but well above 6060. That is chef’s kiss perfect. I got my delta exposure, reduced the noise, and netted a win.

We stayed right beneath the upper strike, and well above the lower one!

Don’t Be the Fool (Liquidity Hunts)

Thursday: I was bullish again, eyes on 6076 from the previous plan. Price wicked a few points below — cue the whining: “Jay, the level broke! Everything’s ruined!” Nah, calm down.

Think about it this way. Any decent trader can find an obvious level like 6076. But if you’re a sneaky institution with some size to fill, you need some liquidity to be provided. Otherwise you’re gonna move the market too aggressively and be a victim of adverse selection.

So what might you do? Let the market dip below the key area and cause shorter timeframe, less well-capitalized sellers to get excited and start piling in “because the level broke”. If you’re really cunning, you might even do a little selling to get the party started (if you’re interested in observing this nuance on the DOM, our TWT DOM lecture has a detailed breakdown of this. Email me if you’re interesting in learning more).

Some of you call this a “stop run”. In any case, I bought it. My mic actually failed on the live at that moment so I typed out my plan clear as day. You can see it below.

No if, ands, or buts. Just an entry and stop, which ended up being the low of the day.

Look at that entry ahead of a trend day!

Latest Plan

Overall, last week’s plan came through like a champ. Special shout out to our quant team: they nailed that 6137 “market maker level,” and Thursday we couldn’t manage a close above it. Precision you don’t see every day.

Anyways, one thing I’m looking at to the upside is the structure where the market sold off last time. You can see the liquidity reversal I keep harping about. A low liquidity area turned into a vPOC that has yet to be touched at around 6149. This will be a good area to monitor.

As for immediate levels:

Upside: 6137, 6149

Downside: 6113, 6096

We might get some weird Friday action thanks to a holiday weekend and potential Trump headlines, so I’m not going all in. I’ve had a good week—I’m not about to fling it all away on random noise.

By the way — if you want my chartbook so that you can also see these levels forming clearly — it’s available for free in the Discord.

What Stock We Bought

Alright, time for the side quest. While everyone else was drooling over “FartCoin” or panicking about the next meltdown, our quant crew sniffed out a nice value play: $INTC.

Go ahead, laugh all you want — Intel might not be the sexiest name in the chip world. But that’s where the opportunity was. Usual Whale whipped out some old-school fundamental analysis. (Yes, that overpriced Wharton diploma finally got used for something.)

Key takeaway: Intel’s metrics looked cheap compared to peers, and we had a potential catalyst: domestic chip manufacturing’s was set to become front and center when all this DeepSeek nonsense and global supply chain drama settled. So we hopped in.

We took about a $1 drawdown after averaging in. Then it soared over 25%. On shares alone.

Meme me all you want. That’s real money in the bank.

Want More of My Analysis?

If you want to stop dabbling and actually nail highs and lows with some level of precision, get into our premium. Seriously. No more half measures.

Live trading on voice: I trade, you watch (and hopefully learn).

Adam Set's Journal: : Raw, unfiltered trade diaries. If you like the truth and can handle it, this is gold.

Order flow & volatility bots (and the new ETH Bot): Because manual scalping at 4 AM sucks.

Daily Plans: So you’re not lost every morning.

Educational resources: From dissecting DOM to advanced risk management. No stale surface-level fluff.

Here's the deal: We're more packed than a Taylor Swift concert, so premium sign-ups are closed. Yeah, it sounds like we hate money, but we actually give a shit about helping people.

But don't start doom scrolling yet - the waitlist is open. Fill out our survey, and if you're not completely hopeless, you might get in when a spot opens. You've got 48 hours once you get the email, so don't choke.

We don't care if your account is small. Just don't be an asshole and be ready to learn.

Please make sure your responses are thoughtful. We don’t ask about your account size or experience level because we don’t care. All that matters is that you’ll have a good attitude and are eager to learn.

Can’t Wait?

If you’re itching for at least some alpha, hop into our free Discord. You’ll get Adam’s Chartbook, a risk management guide, and occasional real-time insights. Every so often, I’ll even drop a live call if I’m feeling generous—just don’t expect the full sauce for free.

By the way, I’m still answering emails if you want me to eyeball your analysis or you just want to argue about who’s the worst Fed chair in history. I read most of them (except the spammy ones), and I enjoy batting ideas around with folks who actually care about getting better.

Catch you next week,

Jay