- TradeWithTitans Newsletter

- Posts

- How I Caught This ENTIRE Rally

How I Caught This ENTIRE Rally

Also, see what levels I'm looking at next

Traders,

I am a god. That’s it. That’s the intro.

Well—fine, maybe you want details. If you somehow missed an entire week of straight-up green, I don’t know what to tell you. I’ve been pounding the table on this being a bullshit sell, and our members got the heads-up ages ago (by the way, signups are closing soon). But even if you never read my emails beyond the subject line, you should’ve caught the drift.

I literally spelled it out in the subject over a week ago!

When I sent that, ES was trading 5880.

Late to the party? No problem. Tweeted it out for the world here.

The last few mornings I’ve been telling a couple hundred of my closest friends that I think the low is already in

Last night, I sent a newsletter to a few thousand other friends sharing these same thoughts

.. a wise man once said “if you too scare to buy key level call yuo mom”

— Jay 'PoutinePapi' Strizz (@StrizziJ)

8:57 PM • Jan 15, 2025

ES was trading 5980.

The price now? 6100+. The missed gains? Over $10k per contract. The fun had along the way? Priceless.

How I Got the Low

I won’t rehash every detail from the past few newsletters, but it all boils down to advanced market/volume profile concepts—like distribution structures, accumulation zones, and that so-called “valley of death” where the big boys pick up inventory. If that’s foreign, go re-read the last issues. Or don’t, and keep guessing highs and lows like it’s your job.

Anyway, here’s the move in terms of structure:

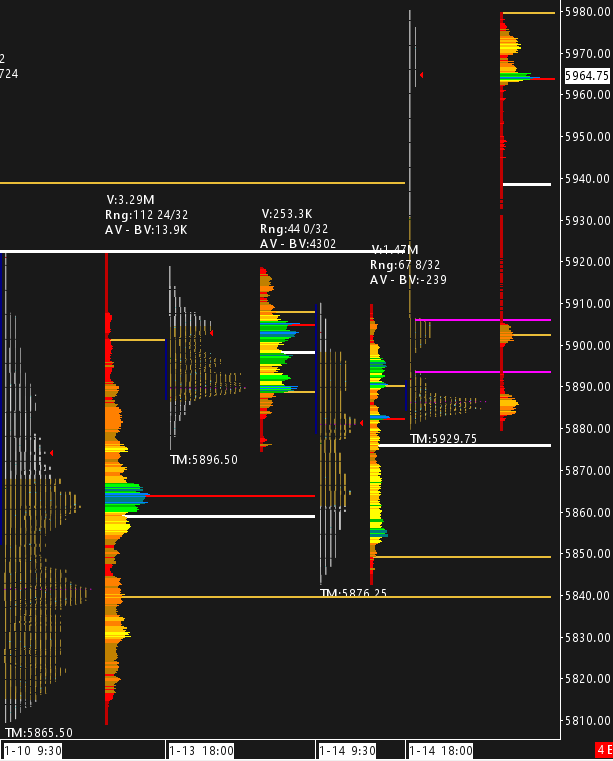

Here’s the profile structure that captures what exactly went down.

I’m breaking this down by skill level so you can see how the same data can be interpreted differently as you get more advanced. Let’s not pretend we’re all gods—some of us are just starting out (and that’s okay, as long as you put in the work).

Beginner

You should at least know the basics of two-way auctions: focus on value, not price alone. Our key downside level was 5817, forming the bottom of the value area (its highlighted in yellow). When the market closed above it towards the days highs repeatedly, it was a heads-up that the market was ready to explore higher value.

If even the beginner level stuff is gibberish for you, everything I just said is broken down in excruciating detail in our intro to market profile video. You can watch it for free here.

Intermediate

Once you grasp how the value area works, notice how the market spent time balancing near the lows before popping higher. That’s classic accumulation—institutions filling big orders quietly. They don’t announce it on CNBC. They work it in a zone, building positions at discounted levels. Why? Big money needs time to fill larger orders (i.e. liquidity) and wants to do so as stealthily as they can. When that pattern emerges (and it’s not always obvious unless you know how to read these combined profiles), you can get in early on some major upside.

Advanced

If you’re advanced, then you actually read the newsletter rather than skimming the subject line. And inside, you know about the 5843 level I was clamoring about to our members.

The market carved out a double distribution, and that 5843 region was basically the center pivot. Once we had a confirmed accumulation below, the market came back down in a subsequent session to kiss that level and bounce off of it perfectly.

That sequence became your best low-risk entry for the next leg up — no real drawdown if you knew what you were looking at. This is how you want to be thinking if you’re a more advanced trader. The logic: big players have built positions, so they defend that region. Price won’t accept below it for long, meaning the profile won’t develop more value down there. This gives you a clear invalidation criteria as well, which is another crucial concept to understand as a more advanced trader. If you took it, you’re probably still grinning.

Expert

You just “knew.” (Kidding... mostly.)

Anyway, if you like my chart book, it’s free in the Discord. I’ve also been doing free live sessions three times a week, so if you’re not making it in there, that’s on you.

What’s Next

I already see the replies forming: “Jay, I missed the move. Now I have FOMO. Where do I buy??”

Slow down. After a swing move like this, we usually chop around before the next big leg. I’m looking at 6107, 6090, and 6075 for potential dip buys intraday.

I have to log off soon for today’s trading session, so if you’re curious about how I derived those levels in detail, just reply to this email. I’ll eventually get back to you, assuming your question isn’t “Dude, which calls should I YOLO?”

Bonus: A New Bot

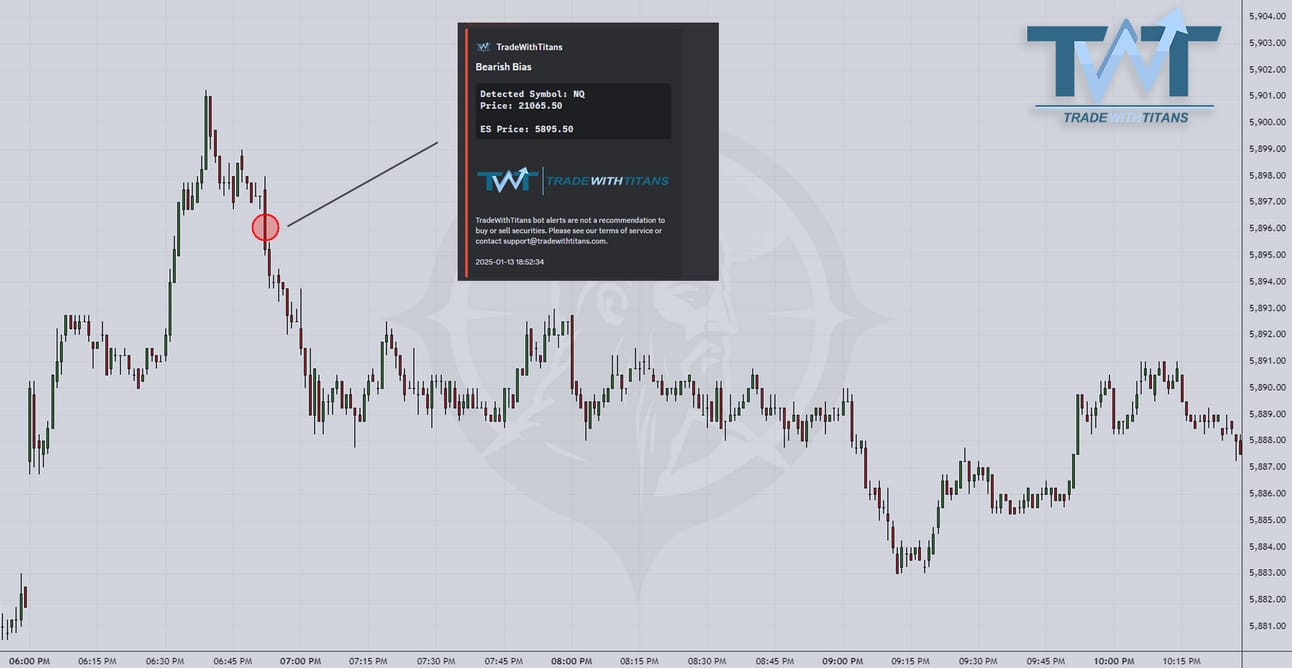

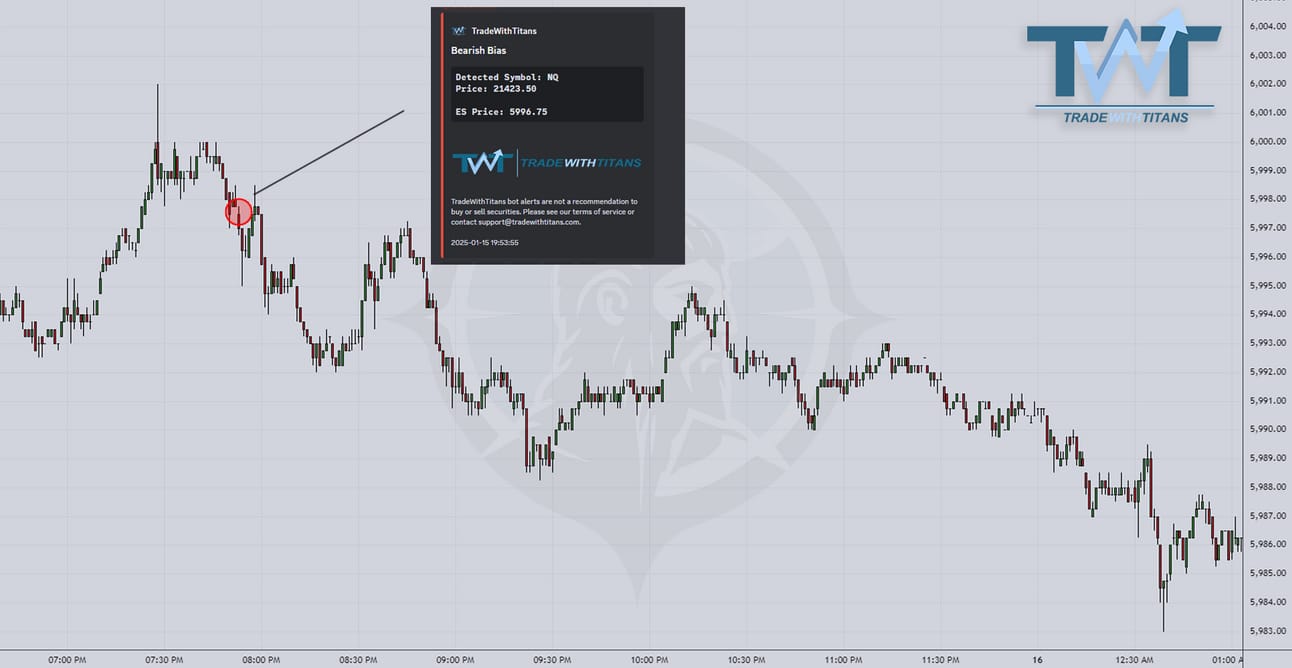

If you’re one of those maniacs who trades both sides intraday, our bots have been insane lately. No rest for the wicked, right?

We just built an ETH version of the order flow bot. If you can’t trade the US session or your time zone sucks (that’s not you lazy PST dudes btw), this is your lifeline. Also, I’ve personally been noticing that in this regime, a lot of the best moves are actually coming overnight. It’s in beta for lifetime members only, and so far it’s been destroying overnight moves. (Don’t worry, we’re gonna roll it out to everyone soon).

For RTH folks, the Vol Bot hasn’t missed a beat. A couple of losing trades, sure, but the winners dwarfed them.

Check out some of the results below!

Full disclosure: these bots aren’t for lazy gamblers. You still need to understand what the data means. But if you do? You’ll wonder how you ever traded without them.

Want More of My Analysis?

If you’re tired of half-assing your trades, do yourself a favor and go premium. I’m cutting off new memberships soon, so this is your heads-up. You know the deal:

Daily live trading on voice: Hear me call trades in real time. Hear me rage if the market does something stupid.

Adam Set's journal: This is like a behind-the-scenes on how a real degenerate day trader tracks every move. No fluff, just raw PnL.

Order flow & volatility bots: The tools I use to spot shifts while everyone else is sleeping.

Daily Plans: So you actually have a blueprint to follow, instead of chasing random candles.

Educational resources: Everything from profiling to DOM mastery. No time-wasting bull, only actionable knowledge.

Our promo codes are expired, but if you really need the help, e-mail me and we’ll see what we can do.

Not convinced? There’s a 7-day money back guarantee, so give it a shot, no risk!

Can’t Join Yet?

Hop into the free Discord. You’ll get Adam’s Chartbook, our risk management guide, and live market insights. Sometimes, I even share bot trades when I’m in the mood.

And if you have any burning questions, reply to this email. I try to answer most of them unless you’re asking me for price targets at 3 AM on a Sunday.

Jay