- TradeWithTitans Newsletter

- Posts

- Scared Money Won't Make Money

Scared Money Won't Make Money

Buy When There's Blood In The Streets

Traders,

They say scared money don’t make money — and this week, scared money got steamrolled.

While FinTwit was busy debating bond market voodoo and prepping for doomsday over tariffs, I was busy doing what we actually get paid to do: trade.

Markets were off their meds again — intraday whipsaws, tape bombs, and twitter (yes, twitter) macro experts pretending they’ve heard of SOFR swap spreads before this week. Meanwhile, I was sitting there like a psycho buying the damn low.

Why? Because I had a plan. And because scared money? Yeah, it never makes money.

Team Effort, Team Win

My (Our) Quants

One of the best things about running with killers? You never trade alone.

Our Quant team doesn’t just spit models and move on — they distill the chaos into what actually matters. No fluff, no overfitted crap, just clean signal.

Take this past Sunday. While the rest of the internet was busy arguing about politics, our quants were hosting a free seminar and dropped the weekly ES forecast. You’ll see the forecast below — and no, it’s not just pretty lines. That baby nailed the range.

Weekly forecast (April 11 close)

This week’s range

ES from 4800 to 5500, tails at the extremes, fat distribution right in the middle — dead ringer for this week’s Volume Profile. Like seeing a cheat code before the week even starts.

And more importantly? They called for risk on before Trump did.

After Tuesday’s close, another one of our risk models flipped from Risk Off to Risk ON — the kind of inflection point you build trades around. I blasted it on Twitter Tuesday night your time.

Just buy stocks and walk away.

Low is in. 91.84% certainty.Any new low will be trivial (not exceeding 5-7%) IMO. Not something to give a shit about. And will be quickly bought.

Better to be in at this discount than miss it all.

— Jay 'PoutinePapi' Strizz (@StrizziJ)

5:32 AM • Apr 9, 2025

Just in time for the biggest intraday point swing in S&P500 history. What happened? Midway through the session, Trump decided to stop playing hardball and paused tariffs — probably after a quick phone call with Jamie Dimon. (Side note, Trump was definitely watching Ackman and the like cry, kick, and scream)

Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately. At some point, hopefully in the near future, China will realize that the days of ripping off

— Donald J. Trump Posts From His Truth Social (@TrumpDailyPosts)

5:24 PM • Apr 9, 2025

But let’s be real… this move was already cooking. Our model knew the market couldn’t keep pressing lower without hitting structural exhaustion. Yields were spiking, bond markets were in full freak-out mode, and fear was everywhere — something had to give. Trump didn’t cause the rally — he just hit the fast-forward button. The market was already teetering on a pivot, and he waltzed in with the headline that broke the tension. Classic Trump move: show up late, take credit, and tweet like it was all part of the plan.

THIS IS A GREAT TIME TO BUY!!! DJT

Donald Trump Truth Social 04/09/25 09:37 AM

— Donald J. Trump Posts From His Truth Social (@TrumpDailyPosts)

1:38 PM • Apr 9, 2025

And don’t forget — Trump literally told everyone to buy stocks that morning.

Too late though, Donny. I already did. My quants told me before you did.

Gamma Labs & Adam Set: A Masterclass in Riding The Trend

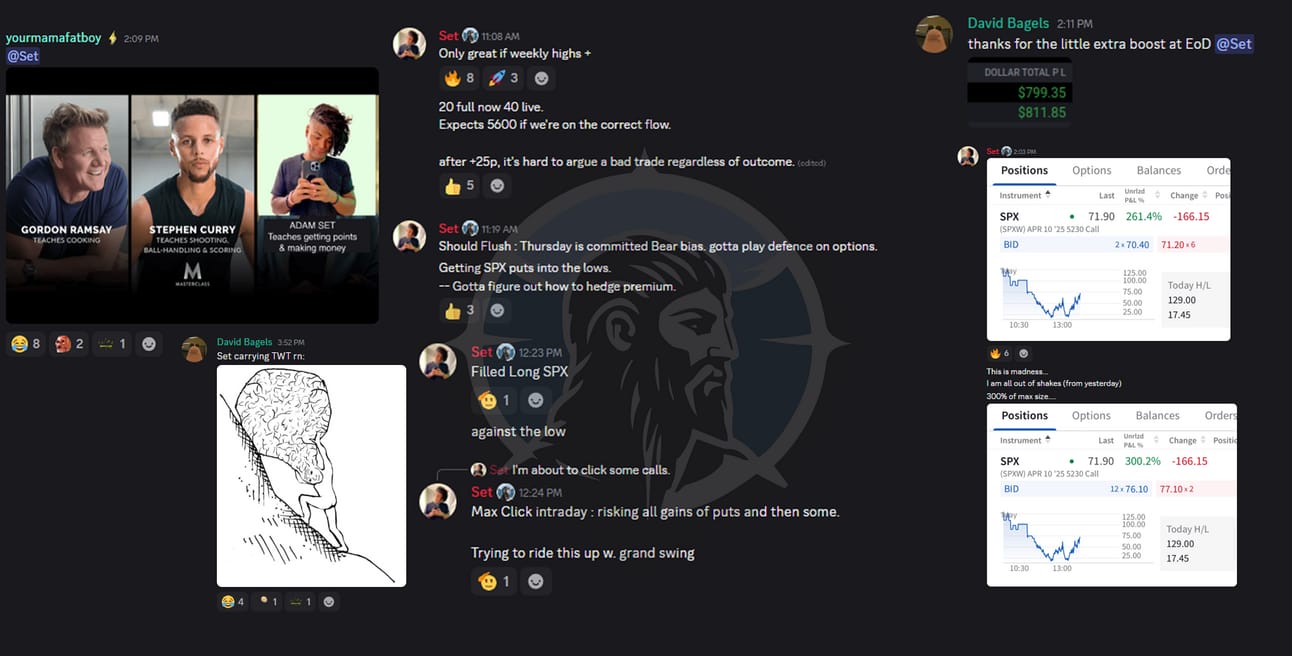

Everyone saw it — Adam Set absolutely nailed Wednesday’s monster move. Caught the trend like it owed him money, and by the end of the day, his PnL looked like something out of a movie. The Big Short Long vibes. Screenshot hit Twitter and went viral — no surprise.

Flat on the intraday : Full Swinging with 5500 so close.

I will remember all of you 💌— Adam Set (@Adaamset)

5:38 PM • Apr 9, 2025

But then Thursday came… and silence.

No tweets. No flexes. Not a word.

People thought the man had slipped into a coin-induced coma or retired on the spot.

Nah. He was just busy feeding the Trade With Titans crew.

🔐🫰 : a very long time

— Adam Set (@Adaamset)

8:08 PM • Apr 10, 2025

While the rest of the timeline was wondering where he went, Adam was in the room, locked in, breaking down the market with surgical precision. No noise, no drama — just elite execution, live education, and another day of putting numbers on the board.

Same with Gamma Labs. These two aren’t here to entertain. They trade trends, they trade big, and when it’s time to go, they don’t flinch — they lead. Watching them operate in this kind of volatility is like seeing a cheat code get entered in real time.

Masterclass. Again.

What’s Next?

At this point, most of the timeline is in a full-blown coin coma — and if you followed along this week, honestly, you should be too.

We didn’t just survive the volatility. We traded the lows, caught the reversal, and milked the biggest intraday swing in S&P500 history. That kind of move doesn’t happen often — and when it does, you don’t push your luck the next day like it’s a casino hot streak.

Remember: the top of our forecast was 5500, and the damn market kissed it. I’m not about to get greedy up here, at least not this week.

But since I know some of you degenerates can’t help yourselves — here’s what I’m watching:

Key pivot: 5316 — top of our expected weekly range. It’s the new line in the sand.

Above that? I’ve got my eye on 5381, 5410, 5481, and then full circle back to 5567.

Below? If we lose 5316 and momentum shifts, we probably carve out a new range with targets at 5230 and 5150.

That’s the map. Use it wisely — and for the love of all that is green, don’t fumble the bag after a week like this.

Rest up. Next week’s a new game.

Want More of My Analysis?

Ready to call highs and lows with surgical precision instead of blindly YOLOing trades? Stop half-assing your trading and level up with Premium.

Live trading on voice: Hear me read the tape live — no hindsight BS.

Adam Set's Journal: Raw, unfiltered, pure alpha on every trade.

Order flow & volatility bots (and the new ETH Bot): Because manual scalping at 4 AM sucks.

Daily Plans: Know key reversals BEFORE they slap.

Educational resources: No fluff. Just actionable knowledge like DOM mastery.

We’re temporarily closed to new premium sign-ups to ensure everyone gets serious attention. Good news: our waitlist is open. Fill out a quick survey. We don’t care about your account size, just that you’re hungry and eager to crush it.

Please make sure your responses are thoughtful. If you pass our vibe check, we'll hit you up when a spot opens. Link stays active for 48 hours, so stay alert.

Can’t Wait?

If you’re itching for at least some alpha, hop into our free Discord. You’ll get Adam’s Chartbook, a risk management guide, and occasional real-time insights. Every so often, I’ll even drop a live call if I’m feeling generous—just don’t expect the full sauce for free.

Any questions? Hit reply. Unlike other guys who ghost, I actually answer and enjoy talking shop.

Catch you next week,

Jay