- TradeWithTitans Newsletter

- Posts

- Volatility Is The New Normal

Volatility Is The New Normal

Central banks aren’t suppressing volatility anymore. The macro is messy. Growth is uneven. Policy risk is real.

Traders,

If you're still waiting for the market to go back to "normal," I've got news for you: this is normal now. Between Fed indecision, recession anxiety, and tariff headline whiplash, volatility isn’t just visiting—it’s moving in. But here’s the thing: heightened volatility doesn’t automatically mean violent new lows. Instead, think of volatility as range expansion—a wide, turbulent playground with plenty of room for big swings in either direction.

What’s Driving The Chaos?

This week, volatility flexed hard, courtesy of mixed economic signals and more tariff drama. U.S. GDP data showed the first contraction (-0.3%) since early 2022. Not a disaster (some forecasts were calling for -2.7%), but still enough to spook markets. The reason? Imports surged over 41% as businesses and consumers rushed to front-run President Trump’s incoming tariffs.

Speaking of tariffs—optimism and pessimism ping-ponged back and forth all week. First, reports hinted China might pause some hefty tariffs, sending Nasdaq names skyward. Later, Treasury Secretary Scott Bessent teased possible U.S.-China talks. Optimism returned, but the backdrop remained murky, and markets reacted accordingly—quickly and chaotically.

Adding to the unease, initial jobless claims jumped to 241,000, well above expectations, suggesting labor market softness is creeping in. That’s not exactly bullish, especially when paired with the GDP contraction.

Tech Earnings Save the Day (Sort Of)

Thankfully, earnings season tossed bulls a lifeline. Microsoft (+9%), Meta (+6%), and Amazon crushed earnings expectations, single-handedly propping up the Nasdaq. But it wasn't universal—names like McDonald’s missed targets, citing wary consumers feeling the pinch of economic uncertainty.

So yeah, volatility? Still elevated. The VIX hovered around 24.60, reflecting just how nervous the market remains despite the recent winning streak.

Balancing Act Ahead

With so much conflicting data, violent directional moves aren’t guaranteed, but neither is quiet consolidation. Expect big ranges, quick reversals, and frequent headline-driven spikes. Just because volatility might find a floor doesn’t mean we won't experience substantial swings.

Take a look at last week’s prep session from our Quants:

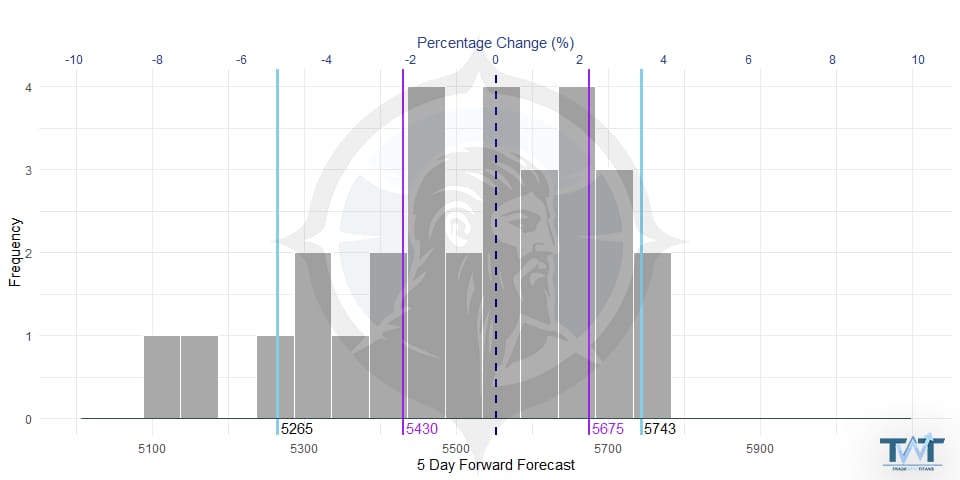

Forecasted bullish scenario indicated a right shoulder between +2% and +4% for the close of this week.

Anticipated weekly range: low at 5430, high at 5675.

And guess what? Heading into Friday (tomorrow), we've nailed it:

Weekly low: 5456

Weekly high: 5682

Spot on. That’s how accurate good forecasting can be, even in a wild market.

But here's the bottom line: Don’t mistake good forecasting for certainty. Volatility is here, likely to stay, and it demands respect.

This is the new normal. Adapt or get run over.

What’s Ahead: Friday Chaos, Sunday Clarity

Look, let’s be honest—this market’s been throwing more curveballs than a rookie pitcher in extra innings. After the wild swings, tariff drama, and Jerome Powell's best poker-face routine, it’s finally Friday. If you’re thinking about diving headfirst into this tape right now, well… maybe reconsider.

Why not grab some popcorn, kick your feet up, and just enjoy watching the chaos unfold instead? You've earned it.

But when the dust settles and you're ready for real alpha (and the levels you’re impatiently refreshing for), you already know the deal—Sunday prep session is where the magic happens. Our quants nailed it last week, and something tells me they'll do it again.

See you Sunday. Until then, stay sane—or at least try to.

Want More of My Analysis?

Ready to call highs and lows with surgical precision instead of blindly YOLOing trades? Stop half-assing your trading and level up with Premium.

Live trading on voice: Hear me read the tape live — no hindsight BS.

Adam Set's Journal: Raw, unfiltered, pure alpha on every trade.

Order flow & volatility bots (and the new ETH Bot): Because manual scalping at 4 AM sucks.

Daily Plans: Know key reversals BEFORE they slap.

Educational resources: No fluff. Just actionable knowledge like DOM mastery.

We’re temporarily closed to new premium sign-ups to ensure everyone gets serious attention. Good news: our waitlist is open. Fill out a quick survey. We don’t care about your account size, just that you’re hungry and eager to crush it.

Please make sure your responses are thoughtful. If you pass our vibe check, we'll hit you up when a spot opens. Link stays active for 48 hours, so stay alert.

Can’t Wait?

If you’re itching for at least some alpha, hop into our free Discord. You’ll get Adam’s Chartbook, a risk management guide, and occasional real-time insights. Every so often, I’ll even drop a live call if I’m feeling generous—just don’t expect the full sauce for free.

Any questions? Hit reply. Unlike other guys who ghost, I actually answer and enjoy talking shop.

Catch you next week,

Jay