- TradeWithTitans Newsletter

- Posts

- We're giving away the Vol Bot for free!

We're giving away the Vol Bot for free!

Plus, learn how Adam and I caught today's lows!

Traders,

I know it’s been a minute. Been working on a lot of cool projects and of course crushing markets. The responsible answer would be "sit on your hands and wait it out." But today’s newsletter is packed with the good stuff, so let’s get right to it.

Agenda

1. How to get the TWT Vol Bot for FREE!

2. The anatomy of how Adam and I absolutely violated today's lows.

3. Where I think this rally might finally run out of cocaine.

Get the Vol Bot For Free!

First up - we're giving away the TWT ES & NQ Vol Bot to 30 of you guys.

For the uninitiated, our quant nerds engineered this beast to spot market reversals using options volatility data. When you combine this with our order flow edge, it's like having X-ray vision for market moves. Best part? It's on TradingView, so you don't need another damn platform.

The Vol Bot in action

Here’s how to get it:

1. Click below and fill out a short survey (~10 mins tops)

2. First 15 entries + 15 random entries by next week get free access

No purchase needed to enter. The full ruleset, terms of service, and alternative methods of entry are all available on our website here.

Today's Masterclass in Bottom Fishing

Today was one of my favorite days in a while. On the morning live, I shared that I was interested in the 5876 level on ES, and we got the entry in less than 30 minutes. Meanwhile, Adam bought 20555 on NQ shortly after seeing some confirmation.

|  |

Our order flow bot joined the party seconds later, giving us beloved confluence.

Bot caught the move right after me.

The rest? Pure poetry. Market closed up 70 points with zero drawdown. Clean AF.

Now, let me break down how we spotted this setup like a hawk spotting a field mouse.

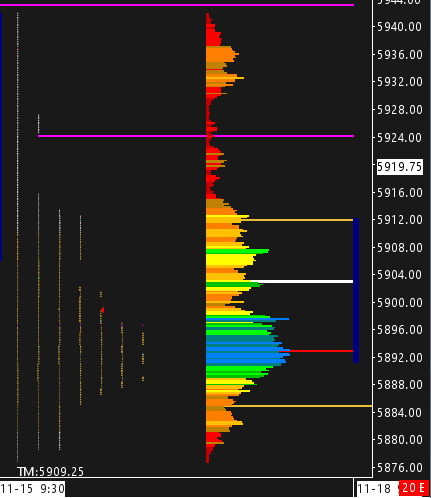

Rewind to Friday. While Twitter was having a collective meltdown about bears taking control, those of us who actually understand order flow saw something different.

Friday’s market & volume profile.

Look at this sexy profile. If you missed my earlier newsletter about these patterns, here's the TLDR: Friday formed a "b" profile cleaner than a surgeon's hands. That means patient buyers were loading up like it's Black Friday. The close above the point of control? That's the first signs of bulls gearing up for the big show. But the real money shot? The bottom of that "b" right at 5876.

So when the market kissed 5876 today, I was ready to go. Those patient buyers defended their turf, and we rode that trend higher than Snoop Dogg on 4/20.

Where I’m Looking Next

Missed today's move? Still fiending for more alpha? I've got two juicy levels for you.

But first, let's do some profile forensics. Here's what it looked like before the sell-off:

Post-election market structure.

See that "P" shape? Clearer than your browser history after your wife checks the computer. For the new kids: "P" profiles are like watching institutions distribute their bags to retail slower than your grandma backing out of a parking spot.

This gives us two spicy levels to watch: 5985 and 6025.

Why 5985? That's where the "P" starts getting thinner than my patience for crypto bros. Low volume here means either buyers get exhausted faster than a CrossFit newbie, or shorts get steamrolled. Either way, we’ll probably know quickly.

6025 is where things get really interesting. Remember how that "b" profile showed buyers accumulating? Well, the "P" shows sellers doing the same shit but in reverse. 6025 is the point of control for the combined profile. I like to think of that level as their average entry - i.e. where they're likely to defend harder than your Twitter opinions.

Am I going full Michael Burry here? Nah. But these are some great levels to monitor, whether you’re looking for targets on long trades or areas for the buying enthusiasm to fizzle.

Jay’s Market Insight

Levels from prior accumulation or distribution zones often serve as longer term areas of support & resistance.

Want More Volume Profile Analysis?

If you want to spot these setups before they happen instead of bagholding like a crypto maximalist, become a premium member.

Daily live trading on voice: Where I break down market structure in real time

Adam Set's journal: Swing trading with the footprint chart

Order flow & volatility bots: Your personal market surveillance system

Daily Plans: Levels for days

Educational resources: including how to find levels and read the DOM

Here's the deal: We're more packed than Coinbase customer service tickets, so premium sign-ups are closed. Yeah, it sounds dumb, but I can only deal with so man of ya.

But don't throw yourself off a cliff yet - the waitlist is open. Fill out our form, and if you show a pulse and basic reading comprehension, you might get in when a spot opens. You've got 48 hours once you get the email, so don't pull a Robinhood and freeze up.

Please make sure your responses are thoughtful. We don’t ask about your account size or experience level because we don’t care. All that matters is that you’ll have a good attitude and are eager to learn.

Can’t Wait?

If you absolutely can’t wait for a spot, go ahead and hop in our Discord. It’s completely free, and filled with goodies like Adam’s Chartbook, our risk management guide, and free live market insight from me when I’m in a good mood. Plus, you might even catch some bot trades.

Got questions? Complaints? Loss porn? Hit reply. I read every email because apparently self-punishment is my kink.

Jay

P.S. If you're not at least trying to get the free Vol Bot after this, you probably still think technical analysis works without order flow. Fix yourself.