- TradeWithTitans Newsletter

- Posts

- What You’re Missing to Unlock Orderflow

What You’re Missing to Unlock Orderflow

Plus, Check Out My Updated Levels

Traders,

Let me guess: you think the market’s gone off the rails. One day we’re pinned in a 5-point range that lulls you to sleep, the next we’re whipsawing 50 points off a Trump tweet or some rumor about an “imminent meltdown.” You’re not alone. But if you seriously believe that kills the order flow edge, I’ve got news for you—you’re dead wrong.

I’m going to show you exactly why orderflow is still the most potent approach out there. If you think I’m hyping it up, well, check out what black magic it helped me pull off:

To recap.

HOD 6123.5

Market chills.

Bought 6086

Risk off 6096.Now riding the rest back up to 6125.

All before market opened. And given in real time.

Bye 💋

— Jay 'PoutinePapi' Strizz (@StrizziJ)

3:09 PM • Feb 7, 2025

“But Jay, I slapped a Volume Profile on TradingView, and the market just keeps blasting through my levels!”

Let’s fix that.

Here’s the agenda:

What Orderflow Secret You’re Missing

How our Plan Did

My Latest Plan

What the Market Maker’s Are Whispering

Ready? Let’s do this.

What Orderflow Secret You’re Missing

A lot of you have heard me rant about TWT’s 3 Tenets of Orderflow. Today we’ll hone in on the first:

The market is liquidity seeking.

I know, I know—“liquidity” gets thrown around like cheap confetti. But ask someone to define it, and you’ll likely hear crickets.

(ELI5) Understanding Liquidity

Think of liquidity like the oxygen in a room. You don’t notice it until it’s suddenly gone—and then everyone starts gasping for air. The market hunts for that “oxygen,” meaning places where trades can actually get filled without mass imbalance. If there’s no liquidity, price can blow through an area in seconds. If there’s tons of it, price might stall and chop until the next wave of aggressors shows up.

In a news-driven market, every major headline sends participants scrambling to figure out if “fair value” just shifted. But guess what they’re all chasing? Liquidity. The market tests extremes—like a toddler pushing every boundary—until it finds enough size on the other side to fill its appetite. Then it snaps back or consolidates in the middle.

Translating That to Actual Trades

So how do we find these “low liquidity” zones where the market might violently turn? Hint: It’s not by scribbling 50 lines on your chart and hoping the price respects them. You look for spots in prior distributions or single prints — places where one side steamrolled the other. We watch for a “liquidity reversal” (our TWT term) in real time.

For example, maybe you’re eyeing a vPOC or VWAP from a past accumulation area. You see the market truck along, then suddenly a wave of orders hits, blowing right through your level — no big players are stepping in, so it’s a “low liquidity zone.” The second we do find big size? That’s the potential reversal point. But you’ve gotta see it on the DOM. No DOM, no dice.

If this is making your head spin, let’s talk specifics:

The DeepSeek Scare

We got an overnight gap down, volatility spiked like it was hopped up on Red Bull. The market was searching for a buyer. Lo and behold, it slammed right into a previous vPOC from earlier in the month. That same level had supported the market on Jan 15th —meaning buyers had historically shown up there. Sure enough, price reversed off it, drifting back to a “fair value” area 80-90 points higher, where it then balanced the rest of the day.

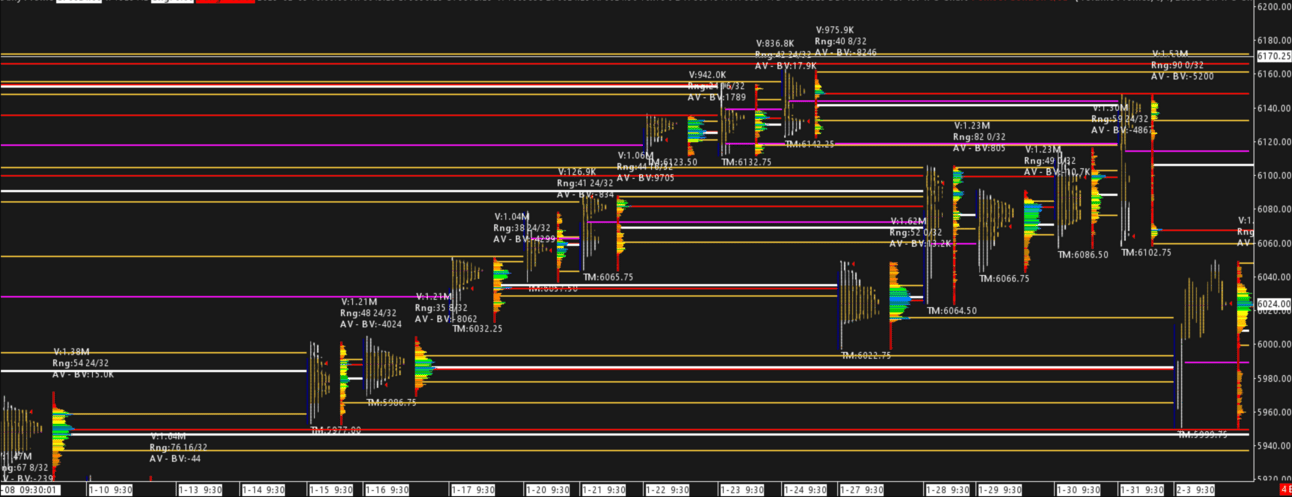

Rightmost Profile: The RTH “DeepSeek” Session

Those who joined our live session got front-row seats to watch our quant Usual Whale narrate the entire sequence while he went long, snatching up points like candy. Meanwhile, everyone ignoring liquidity was scratching their heads, wondering why the market turned on a dime in the middle of “nowhere.” Spoiler: it wasn’t nowhere. It was a known liquidity pocket.

By the way — if you want my chartbook so that you can also see these levels forming clearly — it’s available for free in the Discord.

How Our Plan Did

Remember last week when I gave out a few levels — 6042 pivot, 6059, 6117? Well, let’s just say those levels weren’t random.

Our previous levels were near perfect!

Hardly any trade happened above 6117 or below 6042, except for a brief overnight spasm (thanks, ETH session). And 6059 basically played the role of the MVP, bouncing price twice and giving a sweet entry if you knew to watch it.

If you’ve been following these newsletters, you know this is par for the course. We identify key zones, watch the DOM for signs of a shift, and pounce. Nothing fancy, nothing mystical — just thorough planning and reading the tape.

My Updated Plan

So, what’s next? 6040–45 is still my pivot region. That’s where I switch from bull to bear (or vice versa) based on the day’s order flow.

Downside:

6002 is on my radar. If that cracks, I’ll be checking my pulse and looking at even lower targets.

Upside:

6076, 6096, and 6107 are the next stepping stones if we start to push higher.

Expect some hijinks if volatility picks up. But so far, the broad plan remains intact until the tape tells me otherwise.

What the Market Makers Are Whispering

Our quant team’s cooking up an options-based model that tries to figure out where market makers get forced into heavier hedging. Think of it as a dynamic range where the big players start sweating. This week, they pegged that range’s low around 5962 and the high around 6137 — and so far, we’ve stayed neatly inside it.

The tendency is for big money to prevent the market from closing outside of those levels. If they fail, then your day might very well be ruined. Useful data IMO.

If you like this kind of breakdown, email me so I can convince our quants to keep sharing their wizardry.

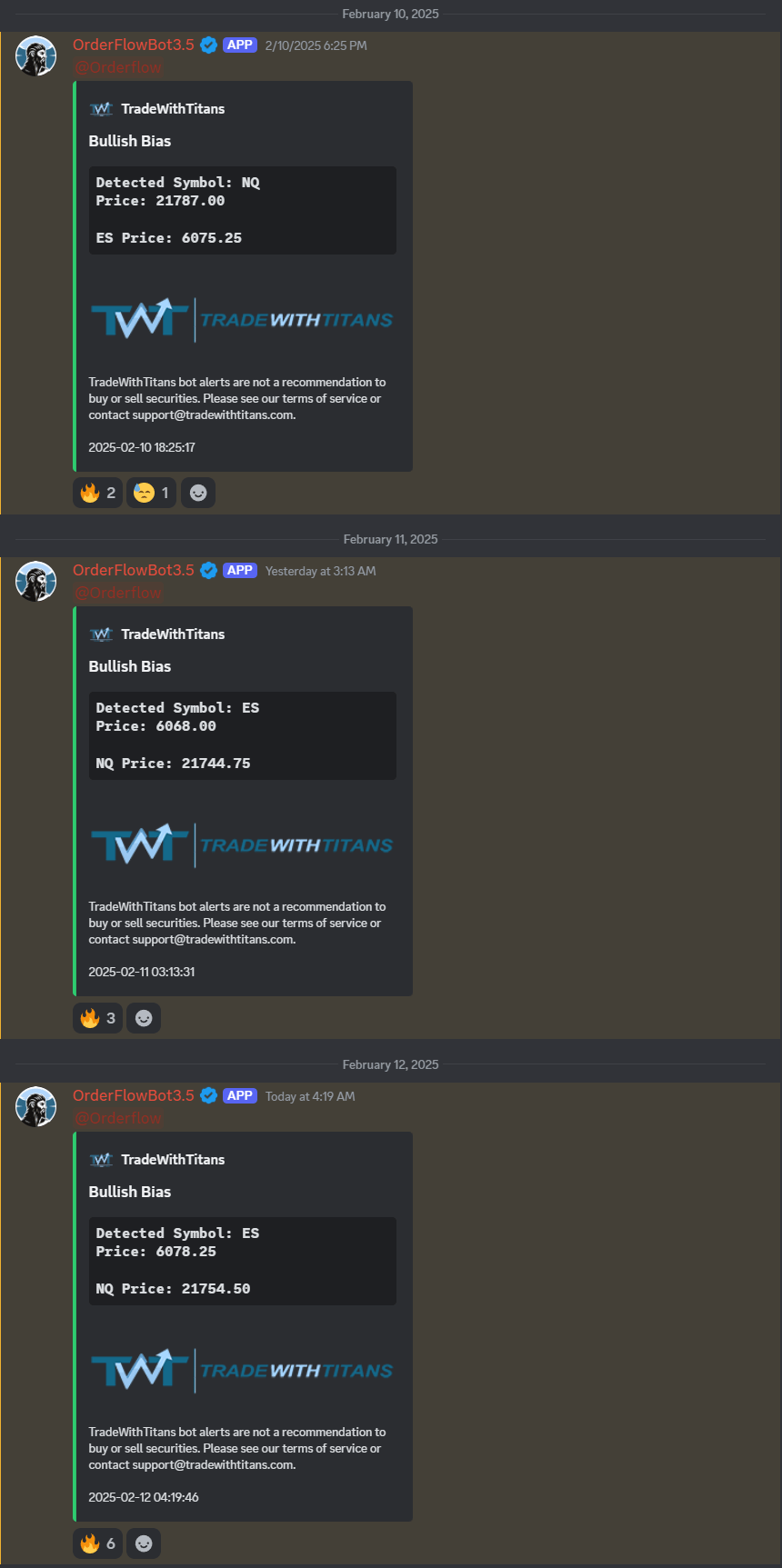

Also, if you’re curious how our Orderflow Bot and ETH Bot are doing, peek at the latest trades. No, they’re not all home runs, but net-net, we’re smiling. That’s more than I can say for half the folks on Fintwit these days.

RTH Bot

ETH Bot

Want More of My Analysis?

If you want to stop dabbling and actually nail highs and lows with some level of precision, get into our premium. Seriously. No more half measures.

Live trading on voice: I trade, you watch (and hopefully learn).

Adam Set's Journal: : Raw, unfiltered trade diaries. If you like the truth and can handle it, this is gold.

Order flow & volatility bots (and the new ETH Bot): Because manual scalping at 4 AM sucks.

Daily Plans: So you’re not lost every morning.

Educational resources: From dissecting DOM to advanced risk management. No stale surface-level fluff.

Here's the deal: We're more packed than a Taylor Swift concert, so premium sign-ups are closed. Yeah, it sounds like we hate money, but we actually give a shit about helping people.

But don't start doom scrolling yet - the waitlist is open. Fill out our survey, and if you're not completely hopeless, you might get in when a spot opens. You've got 48 hours once you get the email, so don't choke.

We don't care if your account is smaller than Elon’s vertical leap. Just don't be an asshole and be ready to learn.

Please make sure your responses are thoughtful. We don’t ask about your account size or experience level because we don’t care. All that matters is that you’ll have a good attitude and are eager to learn.

Can’t Wait?

If you’re itching for at least some alpha, hop into our free Discord. You’ll get Adam’s Chartbook, a risk management guide, and occasional real-time insights. Every so often, I’ll even drop a live call if I’m feeling generous—just don’t expect the full sauce for free.

By the way, I’m still answering emails if you want me to eyeball your analysis or you just want to argue about who’s the worst Fed chair in history. I read most of them (except the spammy ones), and I enjoy batting ideas around with folks who actually care about getting better.

Catch you next week,

Jay