- TradeWithTitans Newsletter

- Posts

- How I Adjust My Trading for Volatility

How I Adjust My Trading for Volatility

Memberships Closing End of Week

Traders,

Let’s skip the pleasantries: if you’ve been getting smacked around by this recent volatility, you’re not alone. But honestly, there’s no need to run to mommy. Volatility is a gold mine when you know how to handle it. So buckle up—we’re diving into how I’ve been playing these news-driven flows and why I’m actually loving it.

Here’s today’s short(ish) agenda:

What’s Been Happening?

My Updated Plan

Quick reminder: memberships close at the end of this week! I’m not saying you’ll never get another chance, but I’d probably be lying if I said the door’s always open.

And for those of you emailing me about how the price is “out of reach,” I hear you. But I’m not in the business of watching people blow their last dime gambling on YOLO trades. If you genuinely want in and need a break, reply to this email, and I’ll see if the team can do something. If not, no hard feelings—but don’t come crying to me if you’re still chasing your tail next month.

What’s Been Happening?

Volatility might be screwing over some of you, but I’m loving it for two big reasons:

Bigger Ranges, Quicker Points

I’d rather grab 20-30 points in one swift move than wait all day for a measly scalp. With volatility, you can catch your trade and be done before your coffee gets cold.

Faster Feedback

I show up with a thesis. If price action says “nope”,I don’t stand around hoping for a miracle — I flip my bias and hop on the other side. Volatility makes me do it fast, which I love.

A few key tweaks to my approach, given these hair-trigger news flows:

Watch Price Action Like a Hawk: You can’t just rely on every single level scribbled on your chart. Sure, I still mark levels, but if DOM is screaming at me that buyers keep stepping in, I’m not going to marry my short. Same if sellers show up with sledgehammers — no level is worth dying on.

Take Profits Quickly: A single Trump tweet (or “breaking news” from half-baked sources) can whip the market 50 points in 30 seconds. I grab a chunk, then let the rest ride with a trailing stop. This way I’m not left crying if it reverses.

Size Down, Widen Stops: Volatility = bigger swings, so if you’re piling in with your usual size, good luck. I lighten up a bit, give the trade more breathing room, and avoid a face-ripping margin call.

Real Example: Last Week’s Plan

Following this approach, we nailed last week’s moves. Let me show you how. By the way, I’m going to use profiles this time, not candlesticks, so you can start to learn the nuances of market structure…

Friday:

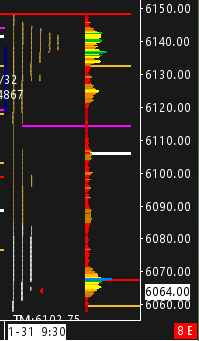

In last week’s newsletter, I told everyone to watch 6132–6142 for sellers. Sure enough, price stalled right there, with no real push above 6142. Look at your volume profile or market profile—pure distribution up top, then a flush.

Once we lost 6106 (my pivot), that was my cue to switch bias to short. You can see VWAP right there (the white line), showing you that the pivot was indeed the middle ground of the day.

The low of the day landed near 6059, which we’d called out a week ago. Thank you, volatility, for making me look like a genius.

Last Friday covered the range from our plan

Monday:

After a wild ETH session, the market got sleepy. The big players just pinned it, crushed volatility, and forced everyone else to wait. I was net long, and 6044 remained solid intraday resistance. No real fireworks, but still a decent day.

Market couldn’t handle 6044.

Tuesday:

Boring Balance. Nothing to write home about.

Wednesday:

A breakout that gave me free points. We saw 6059 get reclaimed, single prints formed on the profile as short-sellers panicked. Beautiful stuff, if you know what you’re looking at.

Just look at those clean single prints.

By the way — if you want my chartbook so that you can also see the distributions forming clearly — it’s available for free in the Discord.

My Updated Plan

Now for the main course. Here’s where I’m setting my traps:

Pivot Level: 6042. Above or below this zone, I switch biases.

Upside:

Watching 6117 and 6152. I’ll be surprised if we close the week above 6152, but hey, this market loves humiliating me sometimes.

Downside:

I’m eyeing 6068 and 6059 for possible bounce plays (a.k.a. the “dip guys” line in the sand).

If we stay below 6042, I like 6002 and 5976 as short targets.

I figure we’ll see some wild knee-jerk reactions if more news drops, but overall, I expect volatility to stabilize soon. (Famous last words, right?)

Want More of My Analysis?

Let me guess. You’re tired of losing sleep second-guessing trades. You’re fed up with half-baked setups from “trading gurus” who flex their Lambos but can’t explain delta. You want to actually catch highs and lows with near-surgical precision—without sacrificing your sanity.

Daily live trading on voice: Watch me rip the tape in real time and call out plays you’ll wish you’d thought of first.

Adam Set’s Journal: An unfiltered, borderline NSFW look into the mind of a real trader. If it’s in his head, it’s in that journal—no fluff, no BS, no sugarcoating.

Vol Bot, Order Flow Bot, and the new ETH Bot: Because manually flipping a coin at 2 AM isn’t a strategy, folks. Let the machines do the heavy lifting.

Daily Plans: If you think you can just “wing it” every morning and outsmart everyone, good luck. These plans give you a road map, so you know where the sneaky reversals might happen.

Educational Resources: From advanced DOM reading to strategic capital management. No stale kindergarten-level “here’s what a candlestick is,” but legit deeper-level knowledge you need to survive.

Memberships at the end of the week! If you want in, do it now — or wait for the next time I get in a charitable mood. No promises.

Our promo codes are expired, but if you really need the help, e-mail me and we’ll see what we can do.

Not convinced? There’s a 7-day money back guarantee, so give it a shot, no risk!

Can’t Join Yet?

If you’re the impatient type, you can at least hop into our free Discord. You’ll find Adam’s Chartbook, a risk management guide to keep you from blowing your account, plus some of my live insights 2-3 times a week!

By the way, if you ever have questions or want me to roast your trade ideas (in a loving way, of course), reply to this email. I actually like engaging with people who show some hustle.

Jay