- TradeWithTitans Newsletter

- Posts

- How I Trade Options for Earnings

How I Trade Options for Earnings

Plus, see how I nailed today's low before the open.

Traders,

Let's talk about that dirty little secret we all have. No, not your weird Reddit browsing history - I'm talking about trading options around earnings. That rush of anticipation, that degenerate dopamine hit when you're right (or the soul-crushing pain when you're wrong) - nothing else quite scratches that itch.

But let's be real. Most of you smooth brains have been absolutely destroyed trying to play earnings. Maybe your "premium unusual flow" alert fucked you, or you called the direction perfectly but still got your face ripped off by IV crush. Welcome to the casino, dumbass.

Me? $TSLA earnings trades bent me over backwards so many times I swore I'd never touch that shit again. That is, until I met Casey. For those who don't know him, Casey's the resident options wizard on our quant team. This beautiful bastard not only did all the galaxy brain math to find actual edges, but he automated everything into tools so simple even I can use them.

The best part about Casey's approach? He finds setups with risk/reward ratios juicier than your mom's apple pie. Max loss is always defined (unlike your gambling habit), and the potential gains are bigger than your ego. This means you can still make bank even if you're wrong more often than right (though Casey hits like prime Mike Tyson).

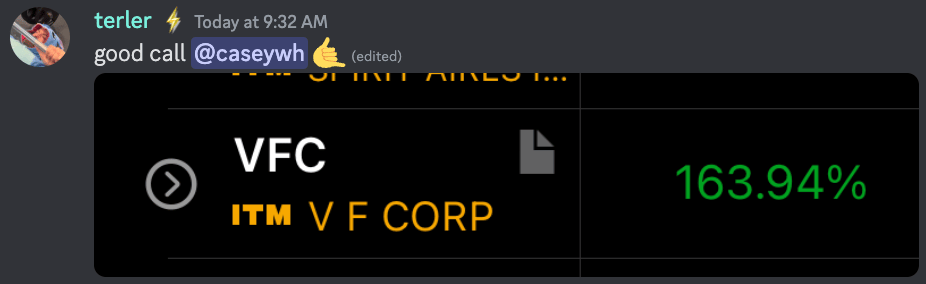

Just yesterday, this madman spotted an insider trade on $VFC betting on a face-ripping earnings and shared it in Discord. Within 24 hours, the room went full Mark Minervini but still cleaned up like a mob hit man.

Quick profits from the $VFC trade

Now, I'm all about teaching you degenerates how to fish. But instead of hearing it from my smooth brain, Casey's gonna strip this trade down for you until it’s bare naked.

How I Called Today's S&P Low

But first, I know you're all dying to know how I nailed today's ES low before the market even opened its eyes.

The setup was something Adam Set covered in a previous newsletter about double distributions. If you haven't read it, stop being lazy and check the archives.

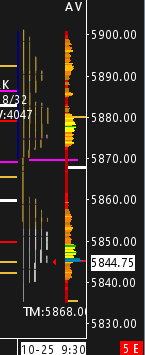

Today's market was looking to open lower. So I pulled up my trusty chartbook (free in Discord, by the way) and spotted this sexy profile from Friday:

10/25 Volume Profile

Look familiar? That's a double distribution so perfect it belongs in a textbook. In TWT, our members have specific rules for trading this structure - it's not rocket science, but it's pretty damn close. We simply long the bottom of the distribution, betting the market will crawl back to the middle like your ex crawling back after drunk texting.

The bounce off the low was so strong I pressed my luck a bit more. The market looked ready to penetrate that upper distribution like... never mind. So I set my target at the middle of the upper distribution instead: 5880.

Closing my position here for +30 points on <3 points drawdown.

1:10 R:R

Flying to France tomorrow to go watch Tennis for a week.

Cya 👋

— Jay 'PoutinePapi' Strizz (@StrizziJ)

4:07 PM • Oct 29, 2024

My 5840 and 5880 levels captured today’s range perfectly.

Not only did we catch the day's high and low like a boss, but we did it with a 1:10 risk/reward. Minimal risk, maximum pleasure - exactly how I like it. If you want my real secret sauce, it's hunting for setups this juicy. And yes, I'm generous enough to feed the whole room.

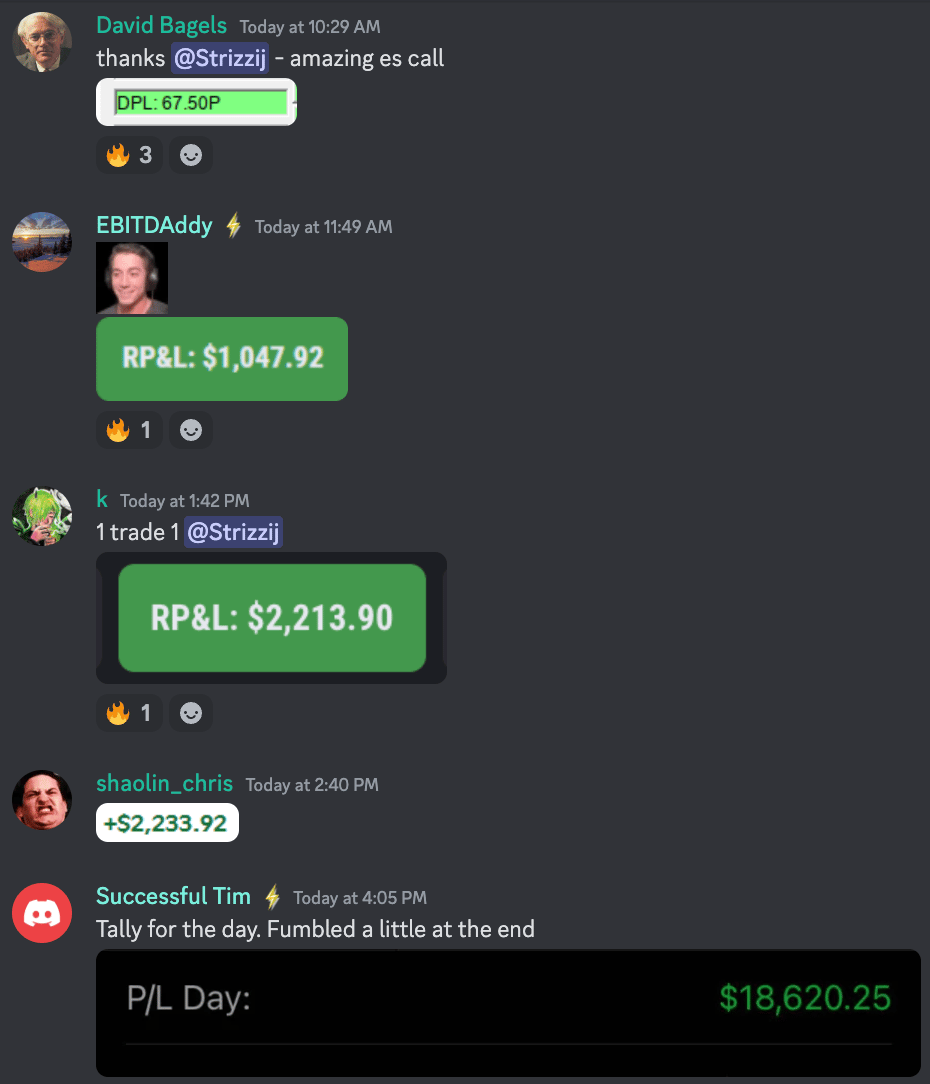

The Discord ate well today.

Casey's Corner: $VFC Trade Breakdown

Earnings season is one of the best times of the year to find trades with options. It is a rare time when new information enters into the equity market and prices can rapidly assimilate the changes into the equity prices. As options traders, we make money when the prices of the underlying assets move, and we can look for opportunities in the flow where it seems likely that someone else has an edge and we can follow.

On 10/28/2024 several companies were announcing earnings including Ford Motor Co. (F), Pfizer (PFE), McDonald’s Corp (MCD), SoFi (SOFI) and others. Our goal is to look at the trades on these names and try to determine if there is any, as I call it, “Information Content” in the trades. We’re looking for trades that indicate high confidence bets that stand out against the background of other trades. Let’s look at some of the indicators.

Clear Catalyst – we are looking for some sort of binary event that we think will move price one way or another. Earnings is the easiest one, but sometimes there are things like trial results, new product announcements, mergers and acquisitions, and so forth. We need to have some idea of what a catalyst might be and the specific timing around it.

Time – options are best used for short-dated trades if you’re looking to make outsized returns. We want to see the expiration of the trade as close to the catalyst as possible, because when it comes to making outsized returns, you don’t want to spend any money on time-value.

Size – the trade should stand out against the background, one good way to tell if this is an outsized trade is if it had to be sent to the floor of the NYSE for execution, it would have the “FLR” flag as part of the trade condition.

New Information – we need to determine whether the trade is a new position opening or if it is an old position that is closing. The easiest way to do this is to compare the Volume (size) versus the Open Interest. If 10k lots hit a contract with 100 contracts of Open Interest, you can assume this is a new position opening up.

Clear Directionality – we need to be able to determine the “intent” of the trade. Can we tell if there is a price target? How is the trade structured relative to implied volatility?

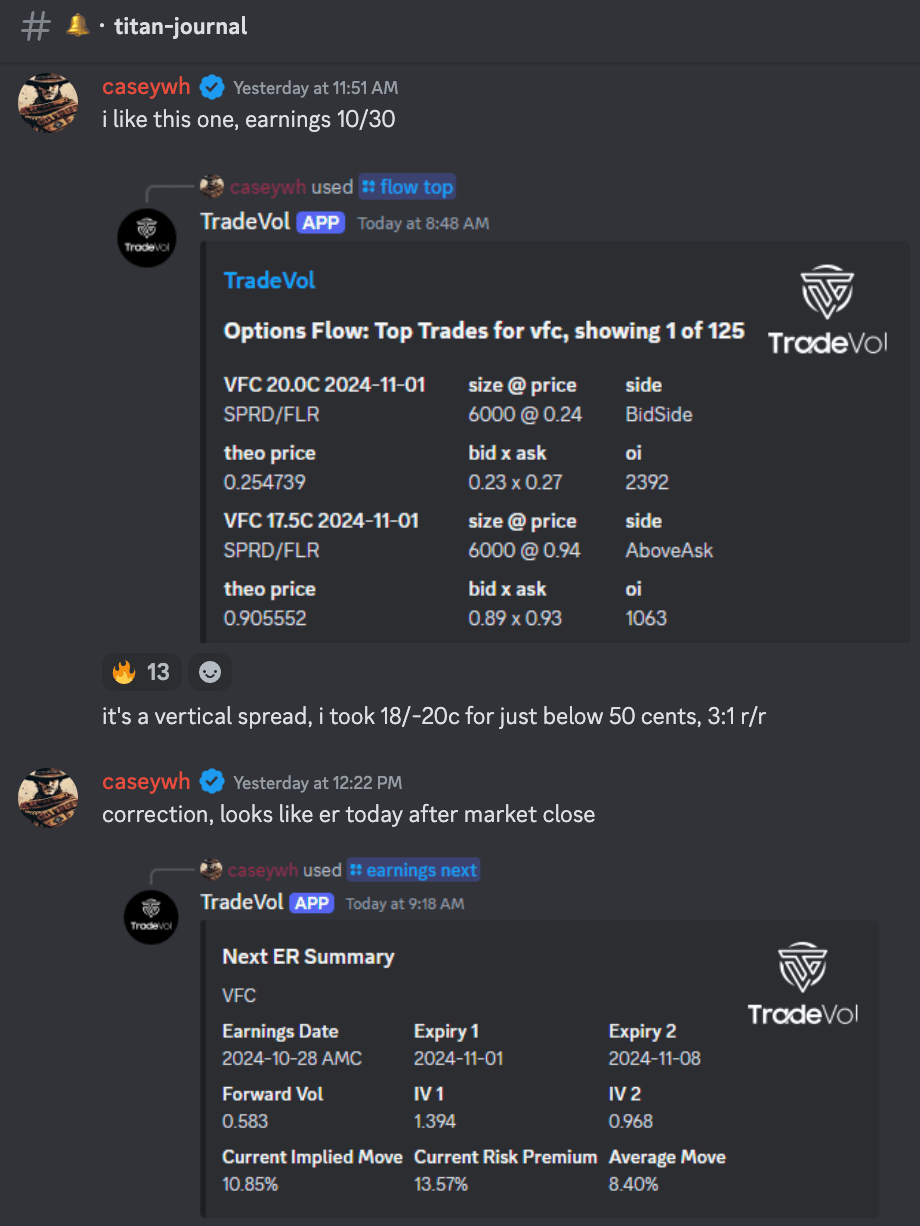

If we put all of these together we can decide whether we think the trader has some inside knowledge that would lead to them betting in the way that they did. So let’s look at the $VFC trade in detail.

Casey shares the $VFC trade on Monday

Clear Catalyst – the earnings announcement.

Time – the expiration of the options in question was 11/1/2024, so only a few days to expiry. This is perfect, the shorter the better. That means we are paying little for time value.

Size – this was the biggest trade of the day, and was executed from the NYSE floor (you can see the FLR indication on the screenshot above)

New Information – the size of the trade was 6000 contracts on 2392 and 1063 OI respectively, so these were definitely opening trades.

Clear Directionality – This is where a little more of the “art” comes into play. The spot price for $VFC was around $17.4, and the trade was long the $17.5 call and short the $20 call. The reason we know it was long the $17.5 call is two ways. One, we can look at the “market” or the bid-ask spread. For the $17.5 call the market was 89 cents bid and 93 cents ask. Since the trade was transacted at 94 cents, we can infer that they had to go and seek liquidity above the current market price. In this case we get the flag “AboveAsk”, which generally is a good indicator that the contracts were bought to open. Similarly for the $20 call, the credit received was 1 cent above the bid price at 24 cents. The other way to do it if the market is wide and price was somewhere in the middle of the spread is to look at the “theoretical” price. This is a carry-adjusted theoretical midprice, and we can decide if the transacted price is above or below this level. The fact that it was a spread over earnings tells me this trader knows what they are doing. When IV is high, typically the vertical spread is the best way to get a high reward to risk ratio on a dollar/dollar basis. The fact that the short leg was at $20 tells me that this was their price target, the reason for this is because the spread won’t increase in value beyond $20, that is where they will get maximum profit. Definitely bullish to $20.

Based on all these criteria, I’m in. Let’s look at how we should take this trade. You can choose to follow exactly how it’s setup, or you can determine maybe you can do better. First thing is let’s understand the risk:reward profile. The price paid for this position is the debit of the long leg plus the credit from the short leg:

-0.94 + 0.24 = 0.70 Debit Paid

The maximum profit is the difference between the strikes, or:

20 - 17.5 = 2.5 Max Profit

The reward to risk ratio is then calculated kind of similar to how gross margin is determined, our profit on our risk over our cost:

(Max Profit - Debit Paid)/Debit Paid = (2.5 - 0.70)/0.70 = 2.57

This reward to risk ratio of 2.57 is just ok. I typically like to get at least 5 as a starting point. I went with the long $18 call and short $20 call, which using the above formula, gets us to 3.16. Still not quite where I like to be, but better than our trader’s position. On a dollar per dollar basis, I have a better reward to risk position.

Now we wait for the catalyst to kick in.

$VFC Update

What happened: VF Corp. stock surged following strong Q2 earnings results, showcasing a turnaround strategy that included debt reduction and improved brand performance, particularly at Vans.

— The Street Sheet (@TheStreetSheet)

8:12 PM • Oct 29, 2024

It’s pretty clear our whale had some insider knowledge, as the equity price skyrocketed:

$VFC rallied following a strong earnings result.

The problem for us now is one of time and price. Our catalyst showed up, did what we thought it would do (> $20 spot price) and now we have to capture the largest fraction of our full edge. We are now entering my opinion space here, everyone can play this their own way, but in my experience we don’t want to sit around after the market opens to “see what happens.” Too many times I’ve seen these things sell back down after the initial surprise upwards in after hours trading where the liquidity is thin. My plan is to sell at open. In order to do this, we should have some idea of what price we’ll get before the market opens because if you market sell, guaranteed you will get a crappy fill and leave money on the table. This is a game of fighting for every penny now.

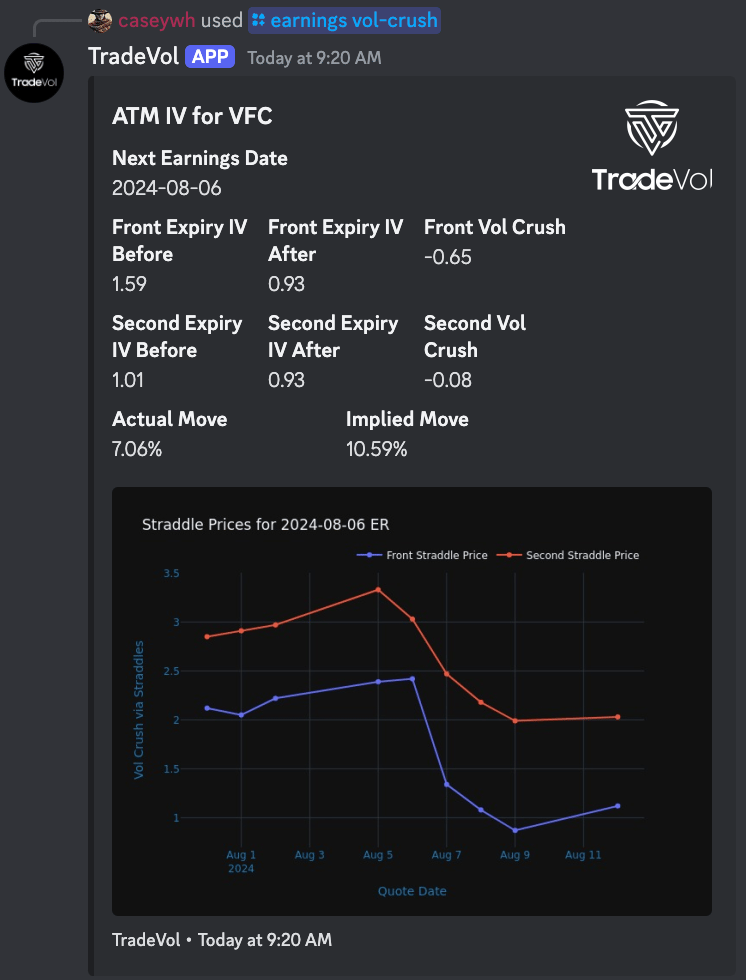

The market looked poised to open around $20.4 on the spot equity price. We can use this info plus some info about past IV crushes to get some idea of where we can expect price to open. We can use the earnings vol-crush tool on TradeVol to look at past earnings results and how far IV crushed to get an idea:

Prior earnings can help us estimate IV crush.

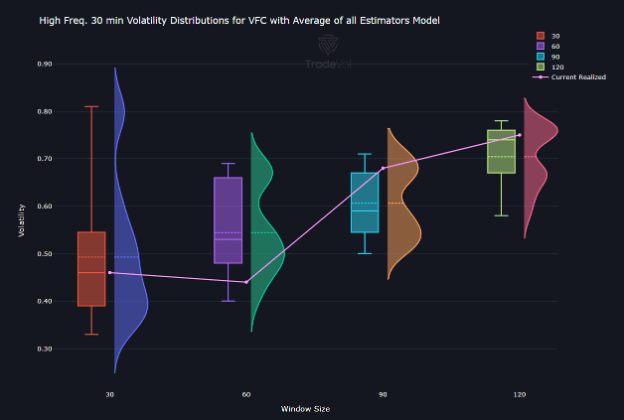

Last earnings we crushed about 65 points, but the front month IV was higher. When it comes to realized vol as a basis, we can use the Single Stock Volatility tool:

The Realized Volatility estimator helps contextualize the IV crush.

Some quick eye-balling of this the median RV should come out to be somewhere around 0.6, but we’re going to gap up about 25% on open so it won’t fall all the way down. I landed on an estimate of about 0.75 vol points for IV at open. We can then put all these parameters into any option price calculator that uses any model you like, I used a naïve Black-Scholes-Merton model that I have implemented in excel: which gave me a price of $1.50.

I started my bidding at around $1.65 right at open, and immediately my fears started to be realized as price dipped below $20. I settled for an exit around $1.35, for a gain of just below 200%. As nothing is ever perfect, price immediately reversed and hit nearly $22, so I left some money on the table. These things happen. It’s not really possible to predict how price will react, so you have to be greedy and take your gains.

Overall, I’d say this was a good trade, as we didn’t keep risk on more than a few hours, we had a clear catalyst and reason for entering, our catalyst was realized, and we made a nice gain. It doesn’t always work out this well, but this I think is a good example of how to use the tools to find real trades that we can profit from.

Want More?

Boy, wasn’t that a gold mine? I pride myself in the fact that TWT’s free content is miles ahead of all other paid stuff out there.

But if you want to learn how to find awesome risk:reward setups that'll make your broker jealous, become a premium member. You’ll get:

Daily live trading on voice: Watch me nail the low in real time.

Adam Set's journal: Trading porn that'll make Reddit blush.

Order flow & volatility bots: Because staring at screens is for losers.

Daily Plans: A roadmap for market reversals that even your goldfish could follow.

Educational resources: DOM reading for dummies, Market Profile, and more!

Here's the deal: so many of you joined last month that we had to close premium sign-ups for the time being. Yeah, it sounds like we hate money, but we actually give a shit about helping people.

But don't start crying into your ramen yet - the waitlist is open. Fill out our survey, and if you're not completely hopeless, you might get in when a spot opens. You've got 48 hours once you get the email, so don't fuck around.

If you’ve been on the waitlist for a while, check your Spam folder. We released a few spots recently but heard some emails got lost there.

Please make sure your responses are thoughtful. We don’t ask about your account size or experience level because we don’t care. All that matters is that you’ll have a good attitude and are eager to learn.

Can’t Wait?

If you’re way too eager for a waitlist spot to open, hop in the Discord server. You might have to watch on the sidelines for a bit until you can get in the game, but with the amount of free goodies we have for you, there’s plenty to keep you occupied until then.

Have something more to say? Hit reply. I read every response because apparently, I enjoy pain.

Now go study this shit instead of buying 0DTEs,

Jay

P.S. We’ve released a few spots off the waitlist but heard some of the emails ended up in the Spam folder. Check to make sure that’s not you.