- TradeWithTitans Newsletter

- Posts

- SetFlow Masterclass: How I Banked Going Short & Long This Week

SetFlow Masterclass: How I Banked Going Short & Long This Week

Learn How to Swing Trade with Order Flow!

Traders,

If you got chopped up this week, you're not alone. Market's been pounding highs for weeks, then suddenly dips Tuesday. Bears celebrate for a hot minute before we rocket back up. Classic.

But while everyone else was getting wrecked, I was eating. How? Simple. I watch the tape every session, every minute. Not a single lot gets filled without me knowing.

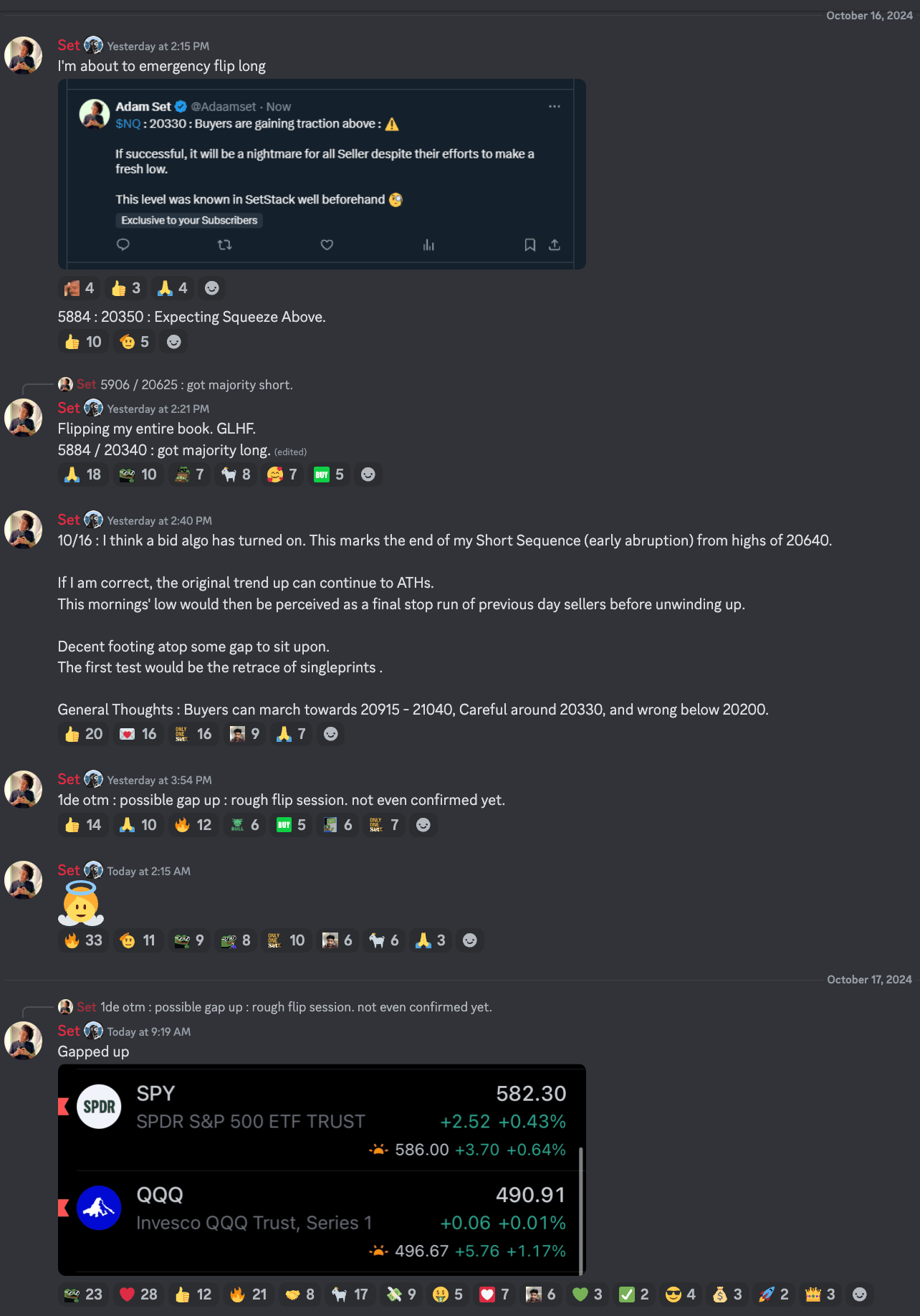

Remember when I shorted Monday's close? Most thought I was crazy. Then BAM - Tuesday's dip hit. But that's old news. The real magic? Flipping long Wednesday to catch the next bull train.

I may be the only one on here who's willing to Swing a +1000p Put, and then flip Long for the remainder of the Auction...

... The very next day (with a +200p gap up!)

— Adam Set (@Adaamset)

3:07 PM • Oct 17, 2024

Now I'm gonna break down exactly how I did it. Pay attention, because this is the kind of alpha that separates the pros from the wannabes.

Stocks to Watch

First, let's check on some SetFeed gems:

$ORLY: Gave this at $1140 on 9/25. Hit $1220 on Tuesday with zero drawdown. You're welcome.

$TDS: Jay called it at $23. Smashed past his $25 target. Hope you ate.

$XOM: New play. I like it around 119 dollar. Target 125 dollar. Don't sleep on this.

Why I Went Short

Monday's tape was screaming short, but most couldn't see it. I'll let you in on a secret: Jay already explained it when he talked about TWT’s 3rd Tenet of Orderflow. If you haven’t already, read his babble about it so you understand what I’m about to say.

TWT Tenet #3: The Market Trades in Distributions.

The more advanced piece he didn’t cover however, is the double distribution. TWT members are already intimately familiar with this idea, but I’ll explain quickly. A double distribution occurs when the market forms two distributions that span adjacent ranges, separated by minimal TPOs or volume.

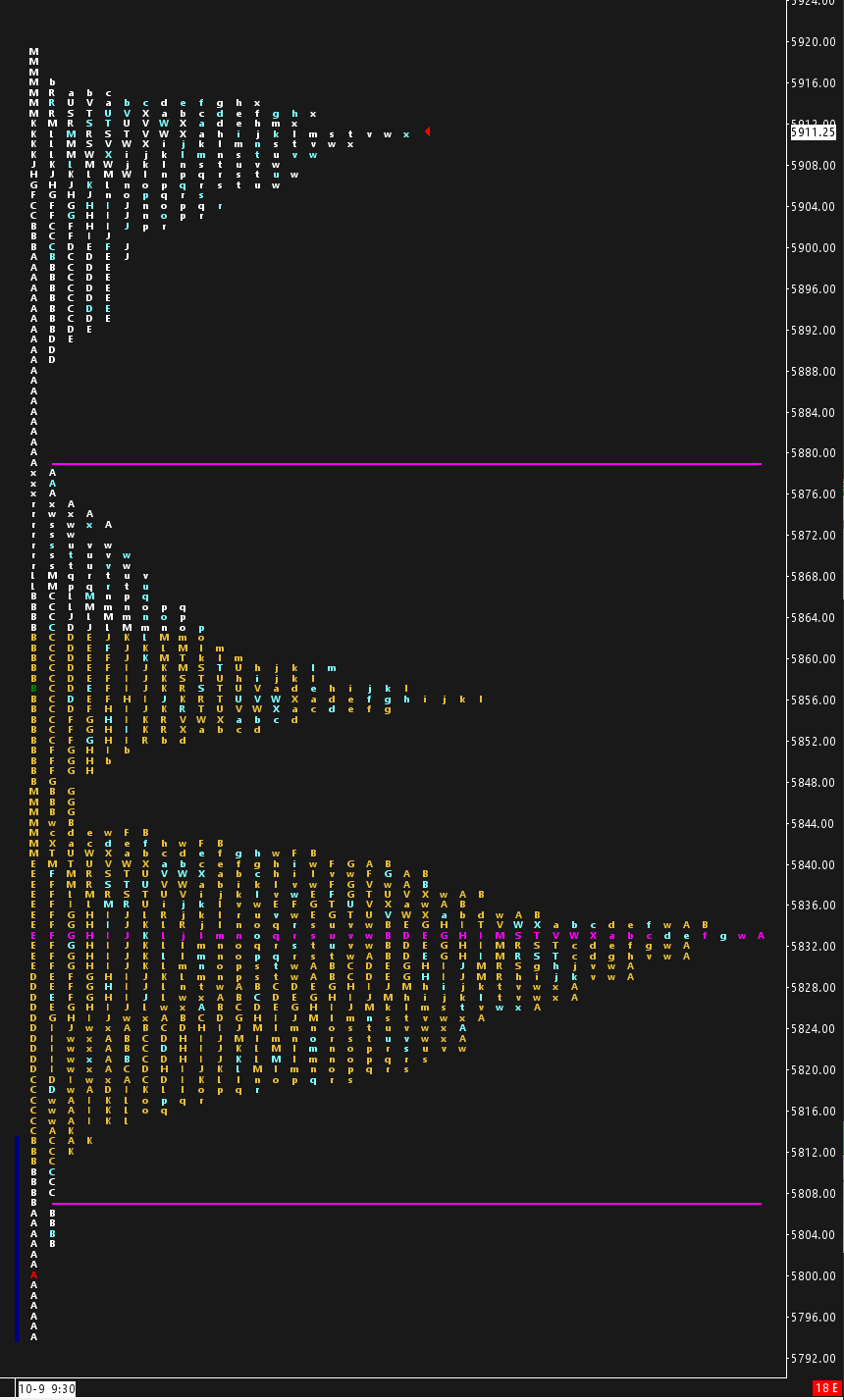

It might just be easier if I show you:

Combined market profile shows a double distribution structure.

The above profile is actually the structure of the market after the closing bell on Monday. As you can see, the market formed a nice double distribution, and we were sitting nicely on top of the second one.

Caveat: Yes, I know the upper distribution isn’t quite filled out and this looks almost like a triple distribution. This newsletter isn’t the right medium to discuss this level of nuance, but it’s something we love diving into during our educational sessions. For simplicity, I’m going to consider this a double distribution moving forward.

For the eager SetU students: if we apply TWT’s Tenet #3, that the market trades in distributions, we already know that it is quite likely the market will auction from one end of the distribution to the other. In the case of a double distribution, the same rule still applies. We’re just looking for the area between the two distributions to be revisited. In this case, that’s a target of 5850 on the e-mini.

Guess what? That was the low to the tick. This is why you pay attention to order flow.

Why I flipped long

Now here's where it gets juicy. How'd I know to flip long? Short Answer: I let the tape talk.

The long answer is a little more nuanced. So bear with me if I start to babble.

In TWT, we have rules for trading double distributions. One of the key ones is as follows:

Between two distributions, the market either reverts or seeks acceptance in new value. Popular targets include the value area, point of control, and the other end of the distribution.

"Market goes up or down, genius!" Yeah, I hear your sarcastic quips.

If we stick to TWT Tenet #3, we know the market will trade according to a distribution. But in the case of the double distribution scenario, we just have to know which one. So how do we do that?

Of course, we could flip a coin and pick one. In all honesty, that’s not the worst idea, and because of the disproportionate risk to reward, it’s likely a positive EV (expected value) trade.

But I think we can do even better. How? Here’s the edge: order flow tells you which.

If we see sellers step on the gas, I’m singing “Makeba” on the way down to new lows. But if we see them cover their shorts instead? Well, “Kiki” has shown her hand.

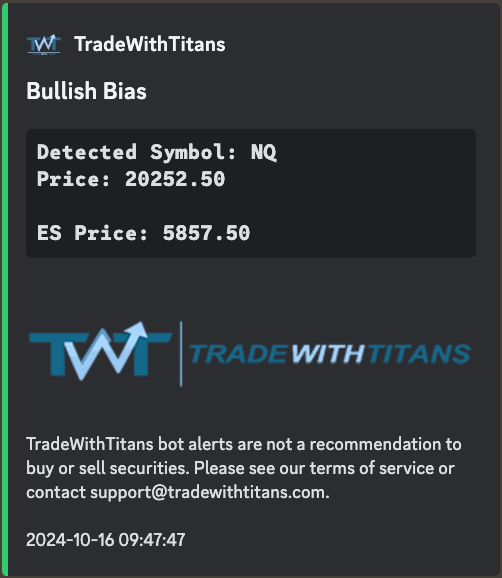

Thankfully, the bots were here to help. Wednesday open, price hits 5850. Order flow bot lights up:

The bot was the first to see the bull tape.

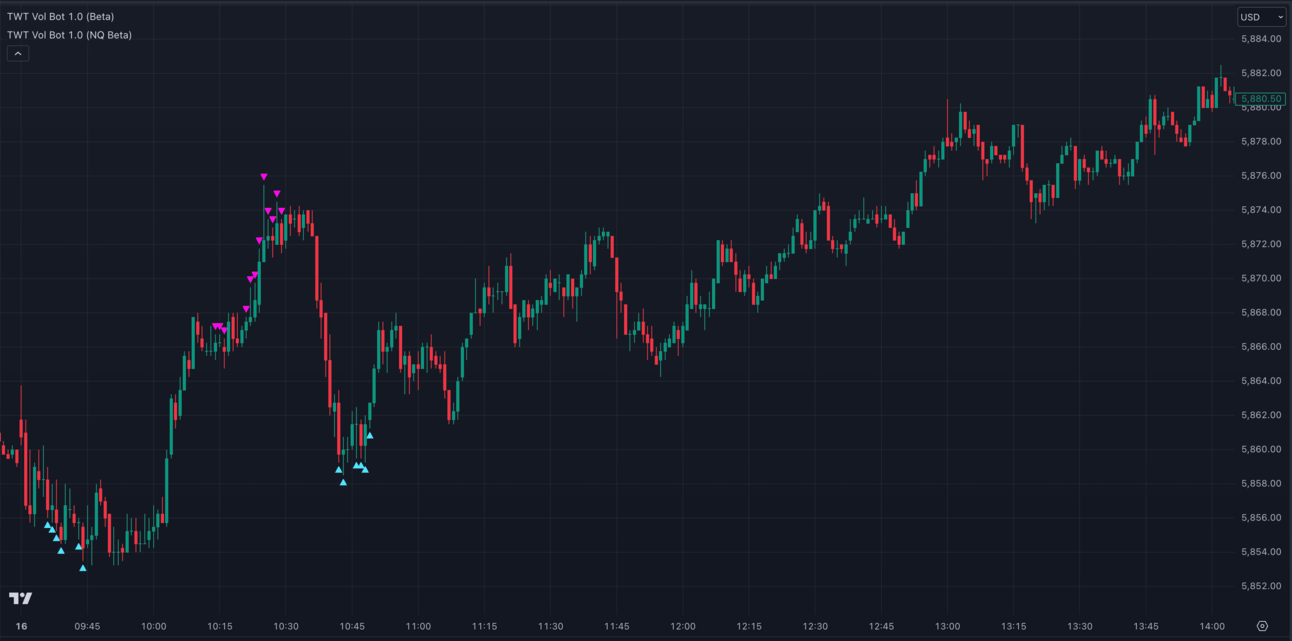

The TradingView VolBot confirmed the bullish bias, followed by a second entry opportunity when the order flow bot’s entry price was retested:

The VolBot catches two long entries based on the options market flows.

Pro tip: I use these alerts as levels, not gospel. They are indications of shifting order flow activity. When price accepted above 5858 and came back to retest it, I expect the same buyers who bought there initially to want to buy more. And well, you know the rest.

Between a double distribution, look for initiative tape for hints on if the upper or lower distribution is next.

So back to the trade. Admittedly, I was a bit slow to adapt. Sue me, I'm human. I was looking to see if the absorption area from Tuesday’s session would serve as resistance for another leg down. But as soon as I was proven wrong, I flipped fast.

My full, unedited journal in TWT showing how I flipped long to capture the gap up.

Flipping bias ain't easy. But remember: there's no “Team Bull” or “Team Bear”. Only “Team Money”.

Want real time breakdowns?

If this breakdown got you salivating, you need to be a TWT premium member. You'll get:

Daily live trading on voice: Where Jay takes points out of the market in the first 30-60 minutes.

The SetJournal: Where I drop gems like this regularly.

Order flow & volatility bots: The edge that keeps me ahead.

Daily SetPlans: All the levels you need.

SetU resources: Master market profile, the DOM, and more

Bad news: Premium's closed due to high demand. Good news: Waitlist is open. Fill out the survey, show you're hungry to learn, and you might get in when a spot opens.

Please make sure your responses are thoughtful. We don’t ask about your account size or experience level because we don’t care. All that matters is that you’ll have a good attitude and are eager to learn.

Can’t Wait?

Want more now? Hit the Discord. It has my free chart book with the exact market profile setup I use to spot that tricky double distribution.

Questions? Complaints? Memes? Reply to this email. Like Jay, I actually read everything you have to say.

Until the next SetJournal bombshell,

Adam Set