- TradeWithTitans Newsletter

- Posts

- I'm Selling All of This — Below SetPivot

I'm Selling All of This — Below SetPivot

Plus, see why Jay is already swinging long.

Traders,

Ah, the timeless debate: Kiki or Makeba.

Do you wanna click 100 times a day or just once — at the right time?

(Kinda rhetorical, you know my style.)

Relax — I already gave you the map in SetJournal, clear as day. But fine, let’s unpack it again.

My Thots

SetPivot

Some say my posts are cryptic. But today? I made it SetSimple™️:

SELL. BELOW. 5640.

That's it. Nothing fancy. This was today's SetPivot—the price that decided bullish from bearish.

Early on, I gave it away openly, no riddles.

Live play by play in SetJournal.

We sliced below 5640, and you better believe I took my piece.

Then what happens? Of course, we got an afternoon squeeze — because market-makers love their games. But guess what happened next?

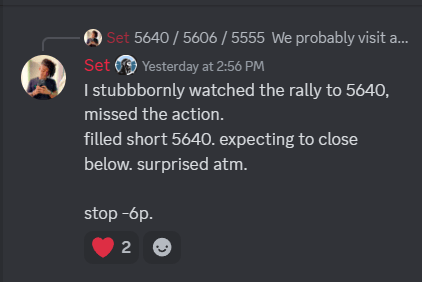

5640 came knocking again, and I shorted it again. Repetition is profitable, if you know your levels.

SetPivot Short Round 2!

And just like that, +150 points on the day ($7500 per contract). Easy, no?

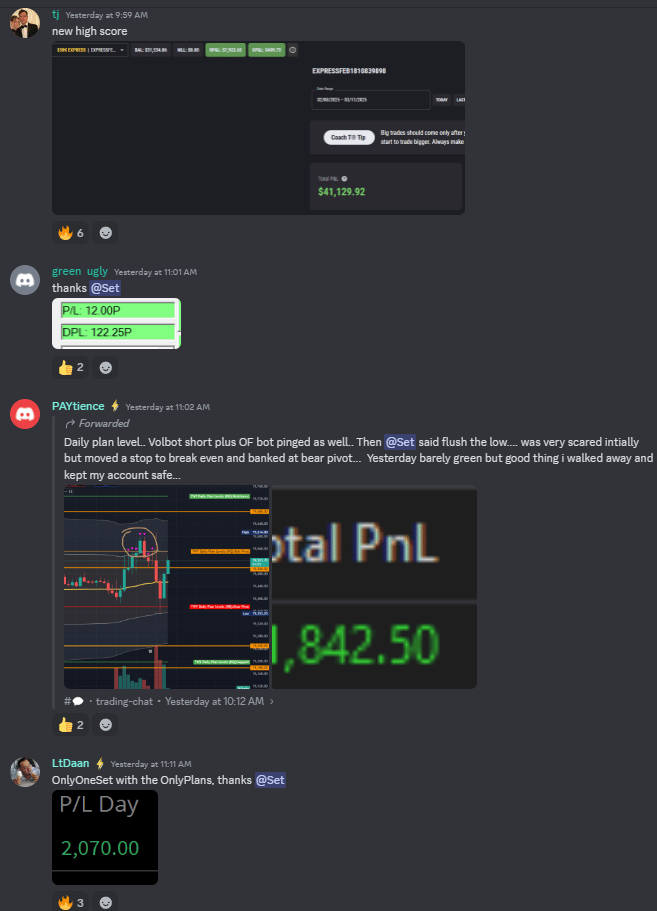

Members feasted too:

This could be you!

I know, stunning real-time usage of Orderflow in my opinion. Solid SetPivot, or nah?

SetPivot.

How’d I Spot This Pivot?

Look, I’m no fortune teller. It’s just Orderflow.

Take a look:

3/10 RTH and ETH profiles showing liquidity reversal

You’ve heard me babble about the concept of liquidity reversals in the past. It’s the same deal here.

Monday profile: no liquidity at 5640 (dead zone). ETH formed a 'P'-shape—clear patient selling — and guess the vPOC? Yep. 5640.

Liquidity tells the tale; Set just reads it.

By the way, if you want my chartbook so you can also spot liquidity reversals, it’s available for free in the Discord.

🔥 SetPlan: What’s Next?

Every time I hand out a crisp +150 points, someone inevitably asks, "Set, what's next?" like I'm your personal ATM.

Alright, since you asked nicely, here’s the SetPlan:

Stay short while we remain below 5640. If we reclaim SetPivot, I’ll switch gears. Targets above pivot? Easy: 5690, 5720, and Jay’s coveted 5748.

Until then, I’m short with conviction.

💡Jay’s Thots

was pretty clear today: he’s building his swing long.

This could be the big one!

Why? Because the TWT quant team (the nerds we love dearly) sees something cooking under the hood.

Last week, Jay gave a clear scenario and a counter thesis. Monday punched the counter-thesis in our face, which saved Jay from eating an MAE sandwich.

Right now, our quant friends are pointing to a volatility fade (they’re short vol, shocker) while accumulating a swing long position. They’re hoping for retests of some of those higher pivots like 5748 and 5850. Stops tight, conviction high.

In other words, the directional clarity Jay discussed last week is delayed by a few days, but coming soon. In the mean time, adding short vol exposure helps keep our ducks in a row.

Do I disagree? No, it’s not schizophrenia — it’s timeframes. For now, I’m feeling the pulse of the tape like a heartbeat. Riding those intraday waves. Jay’s looking a few weeks ahead.

If you want the nitty-gritty, just reply to this email, and one of us (Jay or yours truly) will hit you back.

Tired of refreshing your Twitter timeline hoping to see my latest trade in time? Want live journal updates with real time notifications. Plus the “why” behind how I execute? Look no further, join premium.

If you still doubt who feeds you best, here's your menu:

🎙 Live trading: Jay’s calls alone are worth admission. (Don't pretend you haven't noticed).

🎯 SetJournal: All my setups. Clear. Concise. Alpha stacked.

🤖 Order flow, ETH, & Volatility Bots: My edge, automated.

📈 Daily Plans: All the levels that matter.

🍎 Educational resources: Everything they won't tell you about auctions, DOM, and tape.

Right now Premium is at capacity (yeah, it’s that good). Spots open rarely, and our waitlist is filling fast.

Think you’re SetStudent material? Take a quick survey — staff will screen you in. No faders.

Please make sure your responses are thoughtful. We don’t ask about your account size or experience level because we don’t care. All that matters is that you’ll have a good attitude and are eager to learn.

Need Alpha NOW? 🔥

If waiting hurts, join the Free Discord. Packed with Set freebies: risk guides, charts, and when I'm feeling generous, even bot trades.

Need more help? Just hit me back, and I’ll do my best.

Remember, Set always sees 👁️

Adam Set