- TradeWithTitans Newsletter

- Posts

- SetFlow Post-Election Masterclass

SetFlow Post-Election Masterclass

Plus, Vol Bot giveaway & Casey's earnings trade

Traders,

Election's done. Time to focus on what matters: markets & orderflow. Got three major topics to cover, so pay attention:

Agenda

1. Vol Bot Giveaway (yeah, we’re giving away free alpha)

2. Casey’s Latest Earnings Trade

3. My Market Structure Breakdown (warning: heavy orderflow content)

Vol Bot About to Be FREE 🎁

For those living under a rock, the SetQuant team built something special. The Vol Bot spots reversals using options volatility. The combination of options data & futures orderflow can be extremely powerful, and it’s one of the reasons I love using it. Plus, they managed to get it up on TradingView, so it integrates seamlessly with your existing ecosystem. And best of all, we’re giving it away for free to select followers next week.

Still doubting? Look at today's results:

Vol Bot Signals From Today

Jay will announce the full details of how to take advantage of the giveaway next week. So pay close attention to this newsletter and his Twitter feed.

Casey’s Earnings Trade 💀

Remember Casey's options flow breakdown last week? Well today he showed exactly why his tools can give you that extra edge from that basic shit you're probably using.

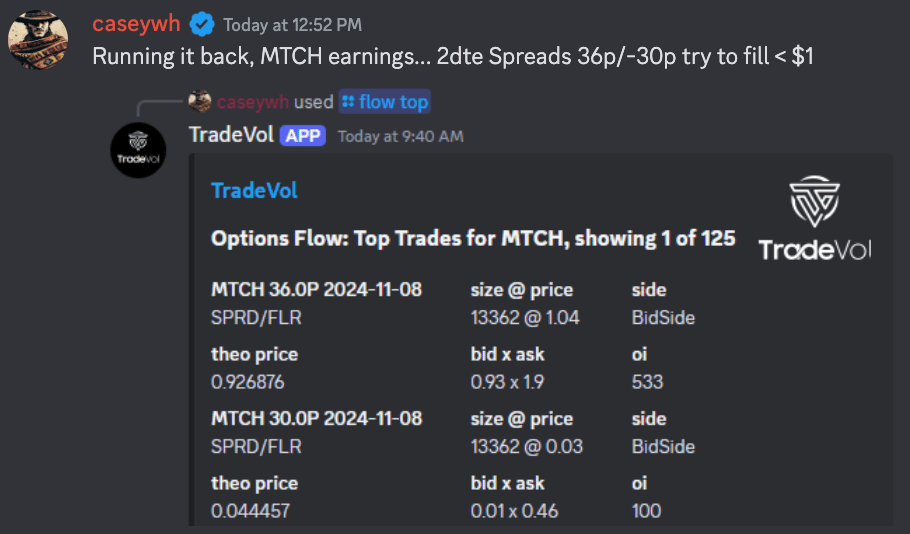

This afternoon, Casey spotted the classic "insider info" pattern on $MTCH puts before earnings:

Casey shares his $MTCH trade in the TWT Discord.

Now pay attention, because this is where most traders get it wrong. Looking at both legs hitting the bid, you'd think it's a 2x sell-to-open or put credit spread. But that's amateur hour.

Instead, check out the "theo price" field on the bottom left. This value is the estimation of what the market maker’s internal models would price the option at. The specifics can get math heavy, but Casey says it relies on a clever application of the implied volatility surface. Comparing the fill price to the theoretical showed this was actually a put debit spread - long 36P, short 30P.

Translation? Someone knew $MTCH was about to get destroyed.

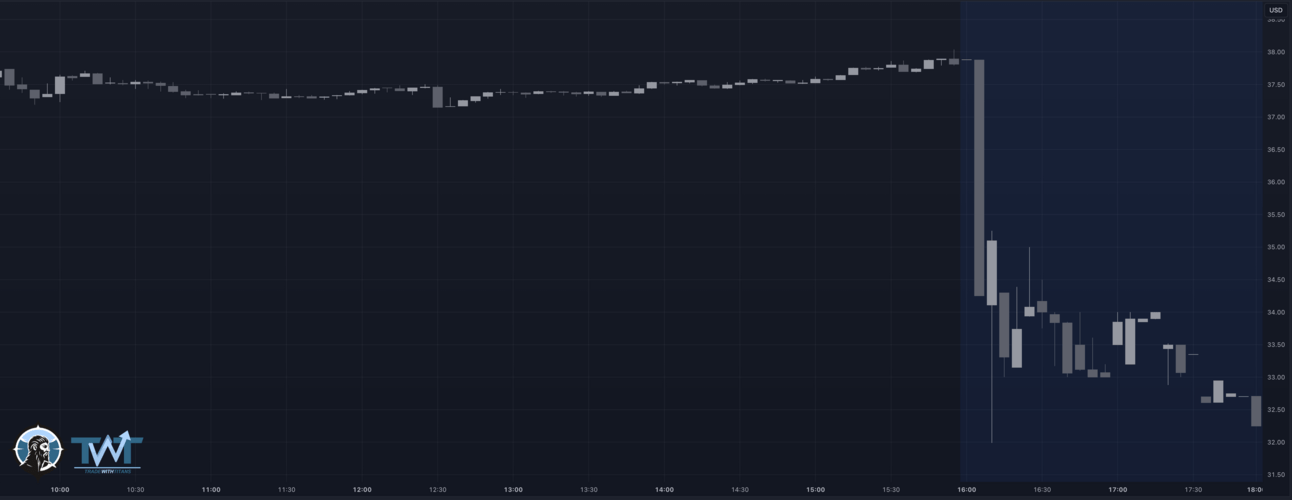

The result? Well...

$MTCH tanked after announcing earnings.

That's how I like to trade earnings. None of that WSB gambling bullshit.

Set’s Market Thoughts 📈

Pay close attention because I'm about to drop some serious alpha.

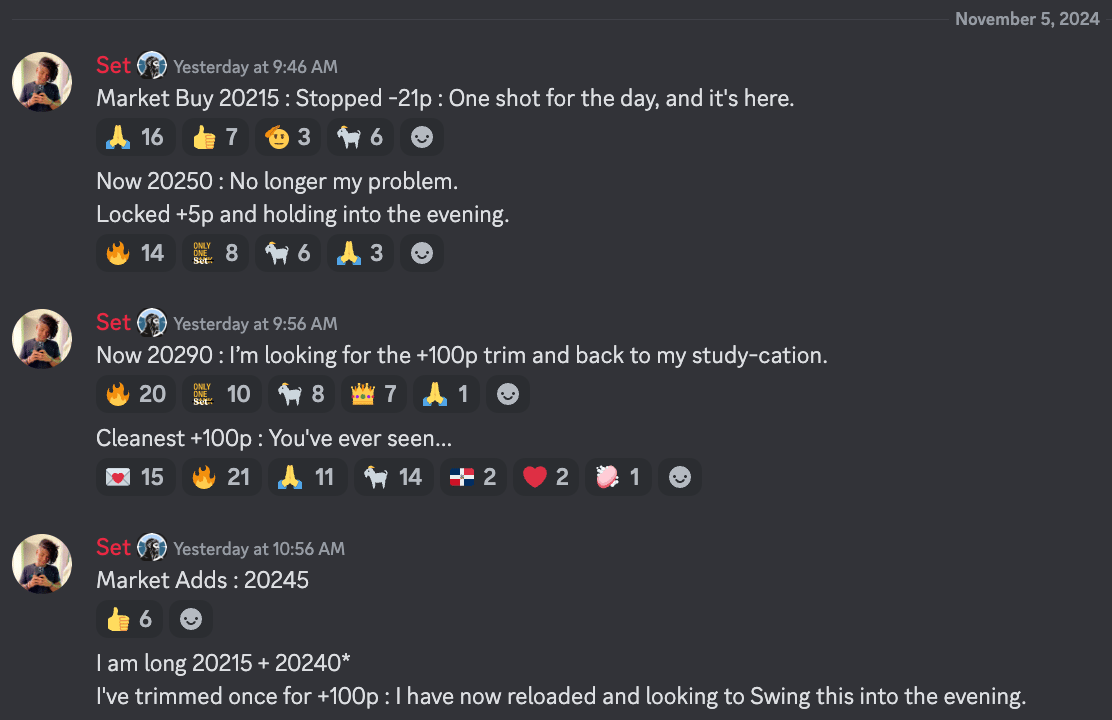

On Monday, Jay broke down volume profile setups for a potential long trade into the election. I saw his thesis developing and went aggressive:

I shared my entries, stops, and targets in SetJournal.

Why did I like this trade? Well, if you remember, Jay was looking for a trade off of the structure from the ‘b’ profile that represented prior accumulation by institutions. He anticipated election volatility might cause a dip into the ‘b’ and give us a chance to get long.

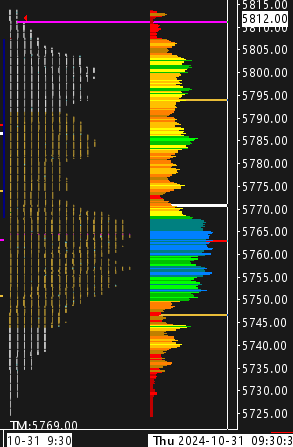

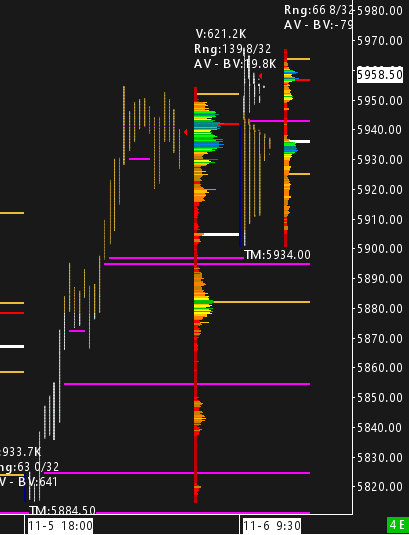

And while he was 95% right, yesterday I noticed something a little odd. I combined the last few profiles and compared it against the ‘b’ shape from earlier. Take a look:

‘b’ shaped profile from September. |  10/31 to 11/04 profiles. |

See that massive volume at 5750-60? Now look at the 'b' profile - barely any volume there at the top.

SetU members know what this means: liquidity reversal. In plain English? Buyers got so damn aggressive they were eating every touch of the 'b' profile. Classic directional positioning. I loaded up fast.

My NQ long paid off big time today.

Now with FOMC tomorrow, here's what I'm watching. Remember that 'P' profile Jay mentioned? The one showing institutional distribution that triggered the selloff? Check this out:

‘P’ profile from October. |  ETH & RTH profiles. |

ETH formed a double distribution and closed in the upper one, above 'P' profile highs. That's acceptance. I stayed long.

RTH? My double distribution rules I shared in an earlier newsletter played out perfectly. First, we dipped into bottom of the upper distribution before the trend resumed. Then, the ETH point of control flipped to single prints in RTH - another liquidity reversal. More strength. Lastly, RTH formed another double distribution and we once again closed in the upper one.

This is how you know the market's eating this move. For FOMC, I'm watching these structural areas. I'll buy dips into lower distribution but if those levels break, I'm out fast.

If this type of analysis makes you hungry for more, you need SetFeed premium:

Daily live trading on voice: Where Jay breaks down market structure in real time

SetJournal: Every trade, every thought process

Order flow & volatility bots: My edge, automated.

Daily Plans: All the levels that matter

Educational resources: Learn to read markets like we do

Premium's closed right now because we're drowning in new members. Yeah, probably stupid business-wise, but I actually give a shit about member success.

The waitlist is open though. Fill out the survey - and make it good. We don’t care about your account size or experience. Show me you're hungry to learn. And you’ll hear from the team if a spot opens up.

Please make sure your responses are thoughtful. We don’t ask about your account size or experience level because we don’t care. All that matters is that you’ll have a good attitude and are eager to learn.

Need Alpha NOW? 🔥

Can't wait? Hit our Discord. It's loaded with free shit - my Chartbook, risk guides, and real-time insight when I'm in the mood.

Did this help you out? Send me a reply. Like Jay, I read every single one of your messages. It motivates me to keep sharing my alpha with you guys.

Adam Set