- TradeWithTitans Newsletter

- Posts

- Still Time to Grab the Free Vol Bot

Still Time to Grab the Free Vol Bot

Plus, how I milked this market using our playbook

Traders,

Short week, but no rest for the wicked. I’ve got two things for you: (1) your last shot at the Vol Bot, and (2) a masterclass on how I’ve been navigating this market like a surgeon. Let’s dive in.

Get the Vol Bot For Free!

Clock’s ticking, folks. We’ve got 15 more spots for the Vol Bot, and once the offer closes tonight, it’s gone.

For the uninitiated, the Vol Bot is pure alpha. Built by our TWT quant team, it’s designed to sniff out market reversals using options volatility data. Pair that with our bread-and-butter order flow, and you’ve got a one-two punch that’s borderline unfair. And because we’re extra nice, we’ve integrated it into TradingView, so it works seamlessly with your existing tools.

The Vol Bot in action

Yes, it’s completely free. No catch. No fine print. Here’s how you can get in:

1. Click the link below and fill out a quick survey (seriously, it’s like 10 minutes—don’t overthink it).

2. We’ll randomly select 15 entries by tonight to get free access

No purchase needed to enter. The full ruleset, terms of service, and alternative methods of entry are all available on our website here.

Will This Market Ever Sell Off

If you’ve been keeping up, you already know the drill. If not, stop slacking and catch up on the last two newsletters (here and here)

So, let’s talk levels. I’ve been watching the 5985 and 6025 zones like a hawk. These levels come straight out of the ‘P’ profile from a prior sell-off—a textbook case of market structure in action.

The ‘P’ profile from early November.

Jay’s Previous Analysis

The 5985 and 6025 levels from the combined ‘P’ profile represent areas of distribution from longer term sellers.

How’d it play out this week? Let’s see:

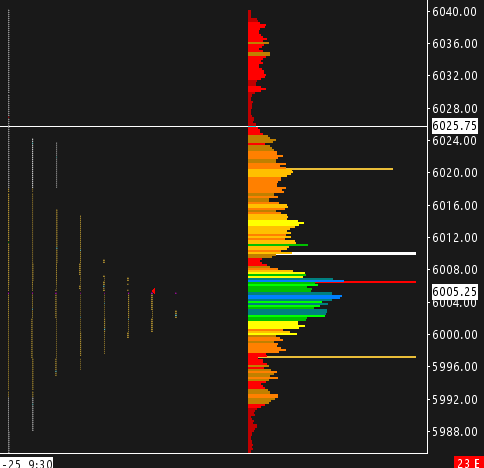

Monday’s Market & Volume Profile

Notice something? Monday’s profile looks like a mini double distribution. And guess what? The market has respected 6025 like it owes it money. It’s the top of the upper distribution, where buyers struggled to trade above.

“Wait, Jay. Didn’t the market rip through 6025 at the open?”

Good question (for a rookie). Here’s the nuance:

Timeframes matter.

When analyzing longer-term levels, you don’t sweat the 1-minute chart noise, especially during volatile periods like the open. We’re looking for longer timeframe sellers. Over 30-minute bars—a standard in market profile—you’ll see the market couldn’t close a single bar above 6025.

Low-volume excess = traps.

Above 6025, there’s a clear low-volume area—a telltale sign of excess. Sellers love this zone because it’s where they can trap buyers into paying dumb prices before the rug gets pulled. If we’d seen heavy volume up there, I’d be worried. But a skinny tail? Chef’s kiss.

Oh, and one more thing. Look at the top of the ‘P’ profile: 6040. That was Monday’s high. Meanwhile, Monday’s low? 5985, of course.

This profile isn’t just holding; it’s dictating the game.

Looking Ahead

Sure, buyers today finally managed a close above the ‘P’ profile. Big deal. It’s a holiday week, which means the rest of this week is just noise. But next week? That’s when things get interesting.

Here’s my playbook:

If we open higher, I’ll watch for retests of 6025 and 6040.

If they fail, weak-handed buyers are toast, and I’ll be targeting 5985 on the short side.

Stay sharp. The market’s a battlefield, and hesitation gets you killed.

Want More Levels?

Want to call highs and lows with surgical precision? Want the levels, the context, and the confidence to trade them? Stop half-assing it. Go premium.

Daily live trading on voice: Watch me read the tape in real time and call plays you’ll wish you thought of.

Adam Set's journal: A masterclass in trade journaling with no BS—every thought, every trade, raw and unfiltered.

Order flow & volatility bots: Your secret weapons for spotting shifts before anyone else.

Daily Plans: A market blueprint so you know where reversals might happen before they do.

Educational resources: Everything from finding levels to DOM mastery. No fluff, just what works.

Use the code “HOLIDAY” (no quotes) for 30% off your first month, quarter, or year!

Not convinced? There’s a 7-day money back guarantee, so give it a shot, no risk!

Can’t Wait?

If you’re too impatient to wait for premium, join our free Discord. It’s packed with value—Adam’s Chartbook, a risk management guide, and live market insights when I feel generous. You might even catch some bot trades.

Got questions? Complaints? Memes? Hit reply. I read every response (and reply to most too) because, apparently, masochism is my thing.

Catch you next time,

Jay