- TradeWithTitans Newsletter

- Posts

- The Levels I’m Watching for Swing and Day Trading

The Levels I’m Watching for Swing and Day Trading

How to stop guessing and start trading with precision

Traders,

Hope you enjoyed stuffing your faces over Thanksgiving. Now it’s time to get off the couch, roll yourself into your trading chair, and get serious. The markets don’t wait for your post-holiday laziness, and neither should you.

December is a minefield: rollover, institutional rebalancing, tax-loss harvesting, and, of course, the holiday snooze fest. If you’ve had a good year, don’t let this market chop you up like leftover turkey. Play it smart.

This will be my last newsletter for a few weeks because (1) we’ve reopened premium memberships, so I’m laser-focused on onboarding new members, and (2) I’m taking a well-earned vacation. But before I sign off, here’s how I’m approaching the rest of the year.

How Did We Get Here?

Just over a year ago, we were hanging out in the low 4000s on the e-mini. Fast forward, and we’re comfortably above 6000. If you told the most die-hard bull that at 4100, they’d have laughed you out of the room. But here we are. Markets don’t care about your disbelief—they care about liquidity.

The question I keep hearing is, “Jay, I want to get in, but it’s too high.”

First off, stop being a nervous Jerry. If you’re a long-term investor, history shows that even buying every S&P all-time high has delivered strong returns over time.

Historically, investing only at all time highs has similar results to consistently investing

Now, here’s the follow-up: “But Jay, what do you do?”

Simple. I invest long-term in low-cost index funds like any non-idiot should. But I also use market structure to deploy capital strategically. Let’s break that down.

Market Structure: The Cheat Code

Markets are just big auctions looking for liquidity. That’s it. They gravitate toward pivotal areas in their structure, which is where the magic happens. If that’s news to you, watch our introductory video here.

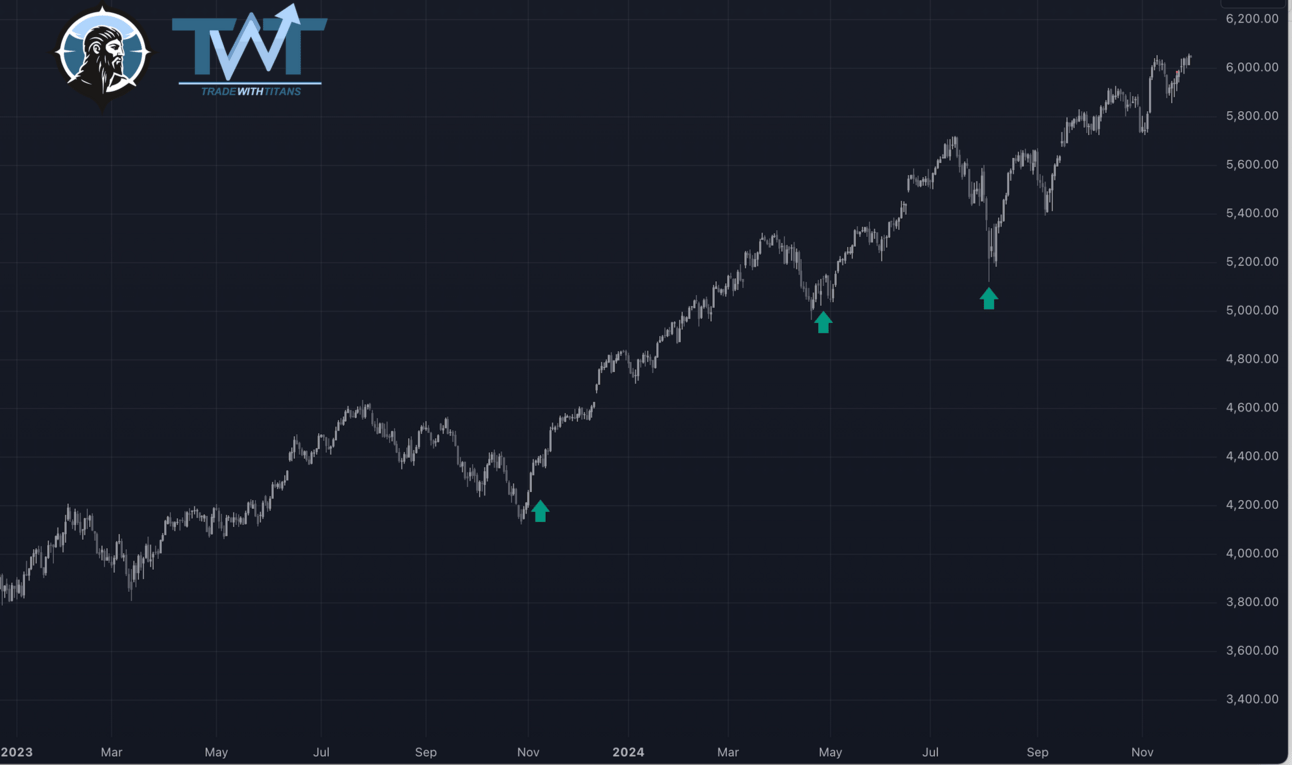

For example, in the past year, I strategically went long exactly three times:

4150-4200 in October 2023

5000 in April 2024

5150-5200 in August 2024

My 3 biggest capital allocations in the last year

At each of these moments, people were panicking—calling me crazy, saying I was buying too early. But these weren’t random guesses; they were key auction areas where the market structure screamed opportunity (and yes, these were shared in the Discord).

In October 2023, sentiment was still scarred from the bear market. In August, the VIX spike had people running for cover. What they missed was the market doing exactly what it always does—revisiting pivotal areas in its structure.

I call these “generational” lows, but here’s the catch: you can’t predict when or if they’ll come back. That’s why I invest consistently. But when the market hands me an opportunity, I’m all in.

Jay’s Investing Mantra

Consistent investing combined with strategic deployments at generational lows is my bread & butter.

So, What Now?

Right now, we’re miles away from any generational lows. The market hasn’t retraced much, but that doesn’t mean we’re flying blind. Let’s zoom in and focus on the market-generated information.

First, revisit the famous ‘P’ profile I’ve been shouting about for weeks. If you’re lost, catch up here and here.

The famous early November ‘P’ profile

In short, the ‘P’ profile gave us key levels: 5985, 6025, and 6040. Last week’s profile reinforces these levels:

Combined Market & Volume Profile for Last Week

Here’s what I’m seeing:

Balanced profile: No major changes in the longer-term auction.

Close at the highs: Bullish, but Thanksgiving sessions are noise.

Low at 5985: Our key level held firm. The value area high? 6040.

Even during the holiday week, the old ‘P’ profile dictated the action.

How I’m Trading This Week

As we begin this upcoming week, I’ll be leaning on this profile to navigate the market in the following ways:

If bulls hold control, I’ll look for long entries around 6040, where single prints should act as support.

Watch the low-volume area near 6007. If we trade there, I’m monitoring for rejection or acceptance.

Below 5990-5985, selling pressure will accelerate as last week’s inventory flips offside. This is the bulls’ last stand.

See how this works? A little market structure, a few key levels, and you’ve got a roadmap to navigate the chaos. No guessing. No gambling.

Want More Daily Plans?

Want to trade with confidence? Want to read the market like a pro and stop winging it? Go premium. Here’s what you’ll get:

Daily live trading on voice: Watch me read the tape in real time and call plays you’ll wish you thought of.

Adam Set's journal: A masterclass in trade journaling with no BS—every thought, every trade, raw and unfiltered.

Order flow & volatility bots: Your secret weapons for spotting shifts before anyone else.

Daily Plans: A market blueprint so you know where reversals might happen before they do.

Educational resources: Everything from finding levels to DOM mastery. No fluff, just what works.

Use the code “HOLIDAY” (no quotes) for 30% off your first month, quarter, or year!

Not convinced? There’s a 7-day money back guarantee, so give it a shot, no risk!

Can’t Wait?

Join the free Discord. You’ll get Adam’s Chartbook, our risk management guide, and live market insights. Sometimes, I even share bot trades when I’m in the mood.

Questions? Complaints? Memes? Hit reply. I read every email (and reply to almost all of them too) because, apparently, I hate myself.

Catch you in a few weeks,

Jay

P.S. If you’re still not trading with market structure, you’re basically flipping coins. Stop it.