- TradeWithTitans Newsletter

- Posts

- Why My Swing Long Will Print Harder

Why My Swing Long Will Print Harder

Plus, My Quant Team’s Galaxy-Brain Thesis on the Post-Opex Rally

Traders,

How am I feeling? Absolutely fucking fantastic.

Like Adam said last week, I'm swing long from damn near the lows. Month already made, but if this keeps going, I won't need to trade again till 2026.

Alright, let's dive in:

Intraday Bangers

Quant Team’s Deep Dive

Intraday Bangers

Set, Set, and...Set Again

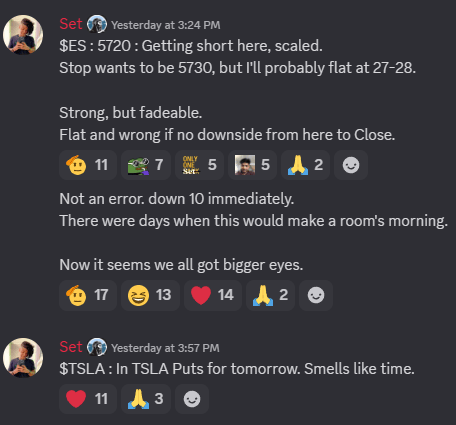

In case you've been sleeping, Adam Set has been calling the intraday moves in the Discord like a sniper.

Dude's been fading fake pumps like it's his job (wait, it is). He crushed yesterday again, obviously.

Doubt it? Here’s receipts:

That 5720 short? Looks tasty as hell now, right?

My Play

I'm still holding the bigger picture view, bullish as hell. If your brain's big enough, skip to the quant analysis below. If not, I'll spoon-feed you the smooth-brain version right here.

I entered when I saw this absolute monster "b" profile:

Then market dropped another juicy confirmation with this second "b":

In case you forgot: in order flow land, “b” profiles often signal patient accumulation from strong handed buyers who have the ability to meaningfully move markets.

Right now, intraday chop means jack shit to me. All I care about are two key levels from that second "b" profile. If we hold above those, I'm golden. If price retests my entry, you'll find me praying to the market gods.

Here's the play-by-play:

Need the market above 5660, ideally 5670.

Targets above: 5720 first, then 5790 next.

Daily closes below? Then we'll talk.

Quant Team’s Deep Dive

Introduction

Today’s options expiration (March 21, 2025) is a quarterly "triple-witching" event—a convergence of expiring stock options, index options, and index futures—with approximately $4.7 trillion in notional exposure. While such expirations usually introduce volatility, in this case, we anticipate it will help stabilize markets.

Key Concepts & Mechanics

Dealer Gamma Exposure: "Gamma" measures the sensitivity of an option’s delta (price responsiveness) to movements in the underlying asset. Dealers who take the opposite side of customer trades dynamically hedge their delta risk. Whether dealers are long or short gamma significantly impacts market stability. Long gamma positions prompt dealers to buy into declines and sell into rallies, effectively stabilizing the market by offsetting price fluctuations. Conversely, short gamma exposure compels dealers to sell as markets fall and buy as they rise, amplifying volatility. Essentially, long gamma acts as a volatility dampener, anchoring markets near key strikes, while short gamma serves as a volatility accelerant. Major expirations can shift dealers’ aggregate gamma positions from short to long, thereby changing their hedging activity from destabilizing to stabilizing.

ETF Option Flows (Covered Calls and Put Writes): Option-writing strategies, such as ETFs and funds systematically selling index calls or puts to generate income, have surged in popularity. Covered-call ETFs alone have grown to approximately $59 billion in assets from just $3 billion three years ago, and now regularly roll over substantial positions each month. When these funds "roll" at expiration, they close expiring options and sell new contracts (e.g., writing April options), creating significant options supply for dealers. A notable analysis from Nomura in late 2023 highlighted that such ETFs doubled in size in 2023 to around $60 billion, leaving dealers heavily loaded with options contracts before major expirations. Practically, this means post-expiration, dealers inherit substantial long option positions, becoming long gamma from these freshly written contracts and supplying the market with additional implied volatility.

Open Interest and Gamma Positioning into OPEX

This particular expiration is exceptionally large. Goldman Sachs estimates roughly $4.7 trillion of equity-linked options expire Friday, marking one of the largest expirations on record. Open interest (OI) in S&P 500 options is especially concentrated around key strikes near current market levels and psychological round numbers. For example, SPX options show substantial OI at 5500 and 5600 call strikes, and heavy put positions spanning 5400 down to 5000 (reflecting substantial hedging via long puts and income funds short calls). These positions are largely tied to the March quarterly cycle and popular option strategies.

Heading into expiration week, overall gamma exposure estimates for the S&P 500 were slightly positive, meaning dealers were net long gamma. However, that positive gamma mainly arises from ultra-short-dated 0DTE (same-day expiry) options. Excluding these, dealers hovered around a neutral to slightly short gamma stance in the days preceding expiration, according to several trading desks.

One critical dynamic involved the large number of protective index puts opened during recent weeks. The S&P’s earlier March decline rendered many of these puts deep in-the-money. Dealers (short these puts) were forced to sell S&P futures to hedge, exacerbating the downturn. With expiration approaching, these put contracts are either being closed or expiring, removing this short gamma pressure.

Consequently, after Friday, a significant portion of these positions will expire, replaced by fresh April/May contracts as income funds roll their option positions. These funds will "refresh" their systematic call- and put-writing strategies, resupplying dealers with long option exposure. As a result, dealers are expected to shift from flat or slightly short gamma into a considerably long gamma position heading into next week, assuming newly written positions remain comparable in size to the expiring contracts.

The Recent Sell-off and Role of Positioning

The lead-up to this expiration has been notably volatile. Over the past three weeks, the S&P 500 declined nearly 9% amid concerns that President Trump’s escalating tariff threats could trigger a trade war and possible recession. This episode featured sharp intraday swings and a notable spike in hedging activity. Evidence suggests dealer positioning shifted to short gamma during the downturn, with dealers losing previously held long gamma exposure as the index declined. By mid-March, dealers approached "peak short gamma," meaning that instead of stabilizing markets, dealer hedging activity reinforced selling—thus magnifying volatility on downward moves.

A direct consequence was a significant spike in volatility measures. The VIX rose sharply into the high 20s at the sell-off’s peak as traders aggressively purchased short-term put protection. Demand for immediate hedges was so intense it inverted the VIX futures term structure, a rare occurrence where front-month volatility exceeded longer-dated levels—indicating acute near-term market anxiety. By yesterday, the VIX settled around 20.66, nearly flat with the three-month volatility index at about 20.71, highlighting unusually elevated immediate market stress relative to the medium-term outlook.

As positioning unwound, such dealer-driven declines often reverse swiftly. Many protective puts reached peak value, and dealers had largely completed their hedging by mid-month. Thus, further declines presented less incremental danger, as dealers had minimal additional futures selling left to conduct. Analysts noted that as expiration approached, put values neared maximum levels, limiting additional hedging pressures unless markets deteriorated further. This dynamic often facilitates a rally into expiration, a scenario we observed as the S&P stabilized and recovered from its recent lows in the week leading into OPEX. This stabilization was driven by short-covering and hedging reversals as dealers repurchased futures positions against decaying put values.

Why Expiration "Clears the Deck": Large expirations remove entrenched positioning. Prior to expiration, traders and dealers are confined within delta and gamma hedging frameworks tied to soon-to-expire strikes. For instance, substantial put positions at the 5400 strike previously forced dealers short these puts to continually sell futures below that level, exerting downward pressure. Upon expiration, these hedging flows vanish, effectively lifting this restrictive force. Additionally, if markets remain depressed post-expiration, systematic strategies such as volatility-control funds or option-overlay strategies may rebalance, often repurchasing equities or reducing hedges if previously over-hedged. Such rebalancing typically supports a short-term market recovery or at least a reduction in volatility following a turbulent pre-expiration period.

Post-Expiration: Potential Rebound and Changes in Volatility Term Structure

Following the March 21 expiration, markets are expected to become calmer due to dealers shifting into a net positive gamma position. With dealers now holding substantial long gamma exposure from new April options, their hedging activity should dampen directional volatility. Specifically, if the S&P 500 rallies sharply, dealers holding long call gamma will sell into strength (moderating upward moves), and if the market declines, their long put gamma exposure prompts them to buy dips (stabilizing downside moves). This "volatility buffering" effect is likely to usher in a more range-bound market phase, making large swings less probable, barring new fundamental developments. In essence, dealer gamma has been replenished.

These changes are already observable in the volatility term structure—the pattern of implied volatility across different maturities. During the recent sell-off, the volatility curve dramatically flattened and even inverted at the front-end, indicating elevated immediate market stress. Currently, the volatility term structure is returning to a healthier contango (upward slope). For instance, by March 19 (two days prior to expiration and after market stabilization post-Fed meeting), the VIX declined to 19.9, while three-month and six-month implied volatilities stood near 20.8 and 21.6, respectively. Longer-dated volatility (around one year) remained elevated at approximately 22–23, reflecting lingering uncertainties further ahead. Just one week earlier, these volatility levels were all higher and closer together—VIX around 21.7, and three-month vol around 22.2.

This recent drop in short-term implied volatility relative to longer-dated levels reflects a steeper volatility curve, a common indication of markets transitioning from stress back toward stability. Short-term risks are perceived to have receded, thus lowering front-end volatility, while longer-term uncertainties (such as trade disputes or policy developments) sustain elevated volatility further out.

To illustrate, the spread between one-year and one-month implied volatility widened back to roughly 2–3 volatility points, after contracting close to zero one week ago. Additionally, the VIX/VIX3M ratio (one-month versus three-month volatility) returned below 1—signifying a normal contango structure where short-term volatility is lower than the medium term. Just days prior, this ratio was near or briefly above 1, an abnormal inversion. Such steepening usually signals market normalization, where investors demand a higher volatility premium for longer maturities due to greater uncertainty, compared to immediate-term maturities. These dynamics are significantly influenced by recent option flows: the rollover selling of short-dated options adds volatility supply, suppressing short-term implied volatility, while longer-dated volatility remains relatively less affected.

Conclusion

In summary, the March 21, 2025, S&P 500 options expiration is expected to reintroduce stability into a market recently shaken by a sharp pullback. The substantial unwinding of open interest—trillions in notional value—is effectively "clearing the deck" by removing destabilizing positions. Significant call and put writing from funds transfers risk to dealers and volatility arbitrageurs, who systematically hedge these positions. Dealers now enter the post-expiration period with net long gamma exposure, which historically leads to calmer markets as their hedging activity counteracts volatility. Concurrently, we observe a pronounced contango emerging in the volatility term structure, indicating near-term fears have diminished, even as longer-term uncertainties remain priced into the market.

Importantly, this technical shift does not guarantee a sustained rally; fundamental factors such as trade policy developments or Federal Reserve actions will ultimately guide market direction in the medium term. Nonetheless, technical forces contributing to recent volatility have largely subsided. Short-term market moves are expected to moderate, given dealers’ renewed gamma cushion. Historically, after large expirations, equities often stabilize or experience modest rebounds in subsequent days as market flows become more benign.

Want More of My Analysis?

Ready to call highs and lows with surgical precision instead of blindly YOLOing trades? Stop half-assing your trading and level up with Premium.

Live trading on voice: Hear me read the tape live — no hindsight BS.

Adam Set's Journal: Raw, unfiltered, pure alpha on every trade.

Order flow & volatility bots (and the new ETH Bot): Because manual scalping at 4 AM sucks.

Daily Plans: Know key reversals BEFORE they slap.

Educational resources: No fluff. Just actionable knowledge like DOM mastery.

We’re temporarily closed to new premium sign-ups to ensure everyone gets serious attention. Good news: our waitlist is open. Fill out a quick survey. We don’t care about your account size, just that you’re hungry and eager to crush it.

Please make sure your responses are thoughtful. If you pass our vibe check, we'll hit you up when a spot opens. Link stays active for 48 hours, so stay alert.

Can’t Wait?

If you’re itching for at least some alpha, hop into our free Discord. You’ll get Adam’s Chartbook, a risk management guide, and occasional real-time insights. Every so often, I’ll even drop a live call if I’m feeling generous—just don’t expect the full sauce for free.

Any questions? Hit reply. Unlike other guys who ghost, I actually answer and enjoy talking shop.

Catch you next week,

Jay