- TradeWithTitans Newsletter

- Posts

- Why This Selloff Has Legs

Why This Selloff Has Legs

The orderflow deep-dive your favorite furu won't (or can't) explain

Traders,

If Citadel has been getting bodied — let's be honest, half of you probably did too.

"Jay, weren’t you bullish at 5850? You still holding those bags?"

If you seriously think I'm still sitting long from 5850, you're beyond help. Jokes aside, this is exactly why we have a plan. When things are easy, just buy tech calls. But when it gets hard, that's where you channel your inner Jay.

Here's today's menu:

WTF Actually Happened?

My Updated Playbook

Simpol.

WTF Actually Happened?

Read. The. Damn. Plan.

Last time, I gave one clear pivot using the volume profile: 5935. This level represented the bottom of a previously balanced distribution. Breaking below it early on Monday was a major red flag. Why? If bulls were genuinely strong, they would've aggressively defended this area, creating responsive buying and rejecting prices below. Or at the very least, they should have lasted longer than your first time. But they didn’t, and the immediate acceptance lower showed me sellers were firmly in control.

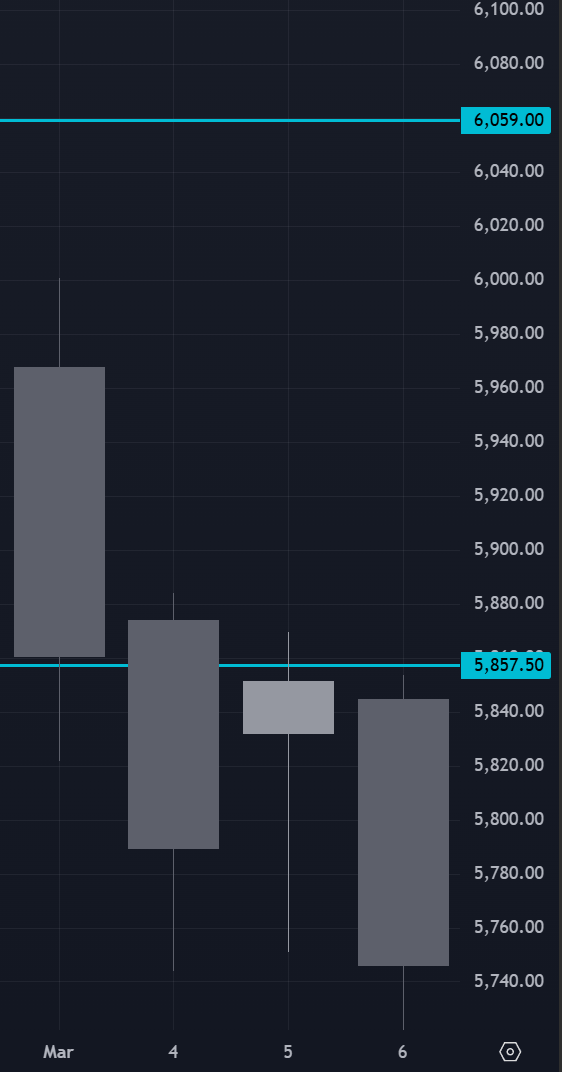

Additionally, recall our Quant team's market-maker lower bound at 5857. I previously explained that closing beneath this market-maker expected range triggers a regime shift in their hedging models — from mean-reversion to trending hedging behavior. Practically, this shift results in market makers dynamically adjusting their hedges by selling into declines (gamma hedging), fueling additional downside momentum and heightened volatility. This is exactly what played out after Tuesday’s close below 5857, and we never opened or closed above it again:

Once we closed below it, we never opened or closed above.

Lastly, our TWT Quant Team's intraday Daily Plans always include a level labeled “Trend Down.” On Thursday, the market broke below this threshold, which signaled sustained intraday selling pressure, advising us against any attempts at knife-catching or counter-trend longs.

By the way, if you ever want one of these daily plans - just email me! If I see it before the open, I may be inclined to share…

My Intraday Strategy

While my broader market bias turned bearish, bear markets notoriously produce large, aggressive intraday rallies. Thus, I prioritized tactical long scalps from key support zones rather than chasing shorts into exhausted lows.

Specifically, during Tuesday and Wednesday’s live trading sessions, I identified the 5748-5750 area using volume profile nodes and liquidity from previous auction levels. Our members executed several successful intraday reversions here:

Members are crushing it!

Remember how in our last newsletter, our resident quant Usual Whale leveraged call debit spreads to weather the volatility but still gain upside exposure? Well, he used the same trick repeatedly this week, and damn if it didn’t work.

On Tuesday, he strategically used 0DTE spreads that closed fully ITM despite the market doing it’s best inverse V impression:

Spread had better than 1:3 R:R too!

And on Wednesday, he began getting swing long, starting with $SPY spreads that went up 50% before close:

I gave the plan. Quants built the optimal trades. The room profited.

My Plan Moving Forward

Where’s Balance??

The current market remains structurally out-of-balance, actively seeking liquidity at extremes. However, it's approaching critical long-term volume profile balance zones indicative of prior institutional accumulation and distribution.

Longer term balance zones

I've highlighted two major zones:

Pre-election institutional accumulation (lower distribution)

Post-election consolidation zone (upper distribution)

Notice how the top of the first zone coincides with the bottom of the second, almost like resistance flipping to support? Yeah, that’s not an accident.

Although we can’t see the intricacies on a candle chart, I expect the the big institutions to once again accumulate down here at these lower prices, before we explore a little higher.

Why is the Selloff Persisting?

I actually think the quant team’s market maker levels explain this perfectly. Due to their expectation of higher volatility and the resulting updates to their hedging models, there are clear volatility headwinds that will last through the end of this week. But, that gives the big players plenty of time to buy down here. The directional clarity will likely come next week, IMO.

The Secret Sauce

If you’ve been a loyal newsletter reader, you know that I love using Casey’s tools to better capture the macro picture.

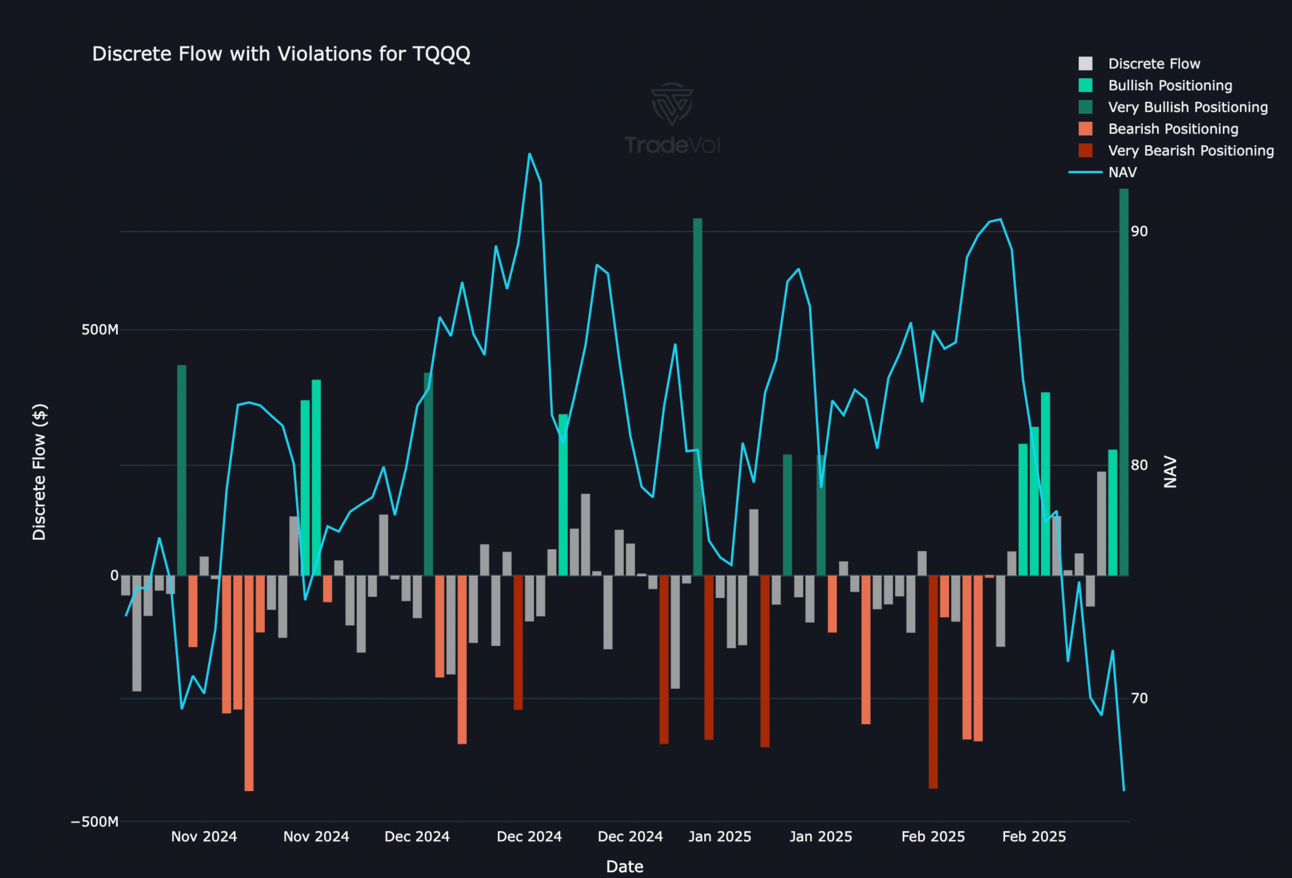

One of his favorite sources of alpha is what we call the ETF inflow/outflow of leveraged ETFs. While quant LARPs love to complain about the decay of these products, they’re often a vehicle bigger money uses to get some quick leverage when they’re expecting a large market move. $TQQQ is one of their favorites:

Huge inflows into $TQQQ on Thursday.

Look at the massive inflow from Thursday. And notice what happened the last couple of times we saw similar action? It doesn’t always mark the bottom, but seems to indicate it’s at least getting close.

My Plan

Now again, just like last week, just because I’m seeing bullish signs, doesn’t mean I won’t adapt if the market tells me otherwise. These are my levels moving forward:

My pivot is 5748. I don’t want to see closes below it if I’m long.

To the upside, I’m looking at 5870 and 5927.

To the downside, I have 5730 and 5867.

Want More of My Analysis?

Ready to call highs and lows with surgical precision instead of blindly YOLOing trades? Stop half-assing your trading and level up with Premium.

Live trading on voice: Hear me read the tape live — no hindsight BS.

Adam Set's Journal: Raw, unfiltered, pure alpha on every trade.

Order flow & volatility bots (and the new ETH Bot): Because manual scalping at 4 AM sucks.

Daily Plans: Know key reversals BEFORE they slap.

Educational resources: No fluff. Just actionable knowledge like DOM mastery.

We’re temporarily closed to new premium sign-ups to ensure everyone gets serious attention. Good news: our waitlist is open. Fill out a quick survey. We don’t care about your account size, just that you’re hungry and eager to crush it.

Please make sure your responses are thoughtful. If you pass our vibe check, we'll hit you up when a spot opens. Link stays active for 48 hours, so stay alert.

Can’t Wait?

If you’re itching for at least some alpha, hop into our free Discord. You’ll get Adam’s Chartbook, a risk management guide, and occasional real-time insights. Every so often, I’ll even drop a live call if I’m feeling generous—just don’t expect the full sauce for free.

Any questions? Hit reply. Unlike other guys who ghost, I actually answer and enjoy talking shop.

Catch you next week,

Jay