- TradeWithTitans Newsletter

- Posts

- Is the Rally Toast? The Level You Need to Watch.

Is the Rally Toast? The Level You Need to Watch.

Plus, how one member milked nearly $50k out of the market.

Traders,

Where the hell have I been the last two weeks? Honestly, the market was boring me into a coma. But thankfully, she finally woke up and gave us some actual volatility worth trading.

Of course, while Twitter had its usual meltdown, I stayed ice-cold.

First, here's me shorting the absolute piss out of Thursday right at the open:

Then casually calling the low on Friday hours before it happened:

Over 250 points bagged in just two days. Not bad, huh?

Alright, enough flexing — I know what you're thinking: "Cool story, bro, but give me something actionable."

Chill, my DOM is open and my levels are fresh. Let's dive in:

Today's Menu:

Stop Relying on Gurus — Learn to Fish Yourself

WTF Caused This Sell-Off?

My Exact Plan Moving Forward

Stop Relying on Gurus — Learn to Fish Yourself

Let's get real. You've probably got your favorite Twitter traders bookmarked, notifications blasting every trade they make. Cool, but what if one day your favorite trader vanishes? Hit by a bus? Or worse, moves to Europe?

When I started out, copying someone's hot trades felt amazing — until it didn't. You can't build lasting success hoping some random dude stays hot forever.

At TWT, my entire goal (yeah, even if it’s stupid business-wise) is teaching traders to fish for themselves.

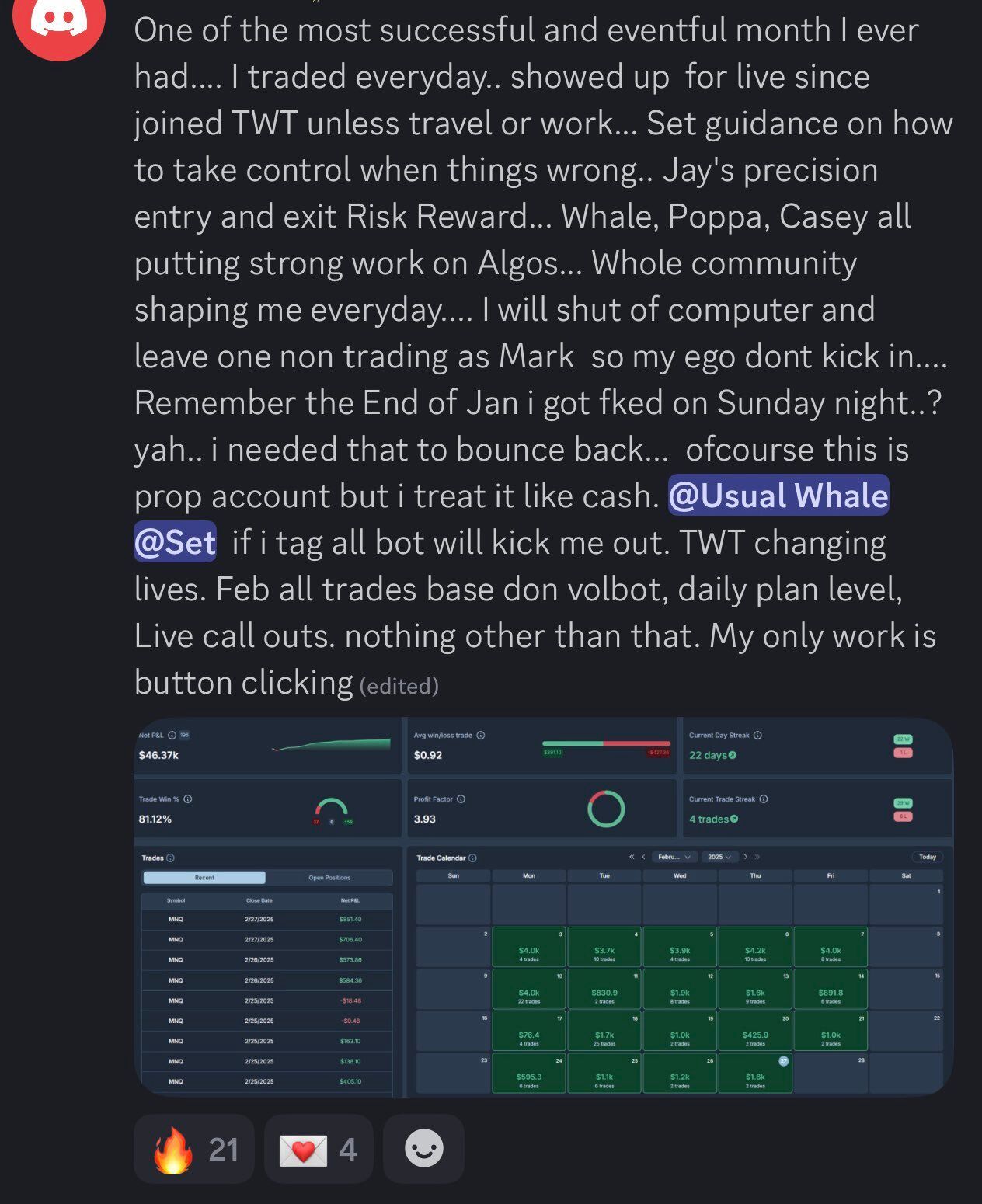

You may have seen me tweet about one of our members (we’ll call him Paul) who absolutely crushed it last month.

I could post about how I piss excellence and shorted 05s live with 200 of my closest friends

But who cares?

Give a man a fish u feed him for a day, teach a man to fish u feed him for a lifetime

Or something like that

If ur ready for consistency u know where to find us 💃

— Jay 'PoutinePapi' Strizz (@StrizziJ)

8:50 PM • Feb 27, 2025

After months of gambling, revenge-trading, and blowing himself up, Paul finally buckled down. He used our risk management guide, stopped YOLOing, and built a rock-solid system.

Last month? Nearly $50k in PnL with an 80% win rate. And no, he's not throwing around giant size — he’s just consistent. Paul’s a perfect example of “slow and steady wins the race.” Remember, trading isn’t about how much you can make today — it's about stacking wins for weeks, months, and years.

But don’t take my word for it, hear the story straight from the horse’s mouth:

With receipts:

By the way — the risk management guide I mentioned — it’s available for free in the Discord.

WTF Caused This Sell-Off?

Balance??

Media loves drama: Trump this, AI CapEx that — whatever. Sure, maybe those matter, maybe they don't. But if you've been paying attention, you know I couldn't care less about the "why." I trade market structure, plain and simple.

Here's a quick refresher: markets are either in balance (range-bound, calm, predictable) or out of balance (wildly seeking liquidity like a crackhead chasing a fix). If you missed my breakdown on market liquidity last month, fix your mistake and go read it.

Check this out. Here's the market for the last month prior to Thursday:

Market’s clearly balancing in a wider range.

Clearly balanced, chilling in a nice tight distribution. But Thursday hit, and BAM — market broke balance, traders got smoked trying to fade it. Lucky for you, I was already short from 6005, sipping my coffee watching everyone panic.

Look Below & Fail

Friday was textbook. When a market is aggressively liquidity seeking, it'll often over correct before realizing that the most amount of liquidity available was actually at a previous location. It’s like you crawling back to your ex after realizing Tinder's brutal. This "Look Below and Fail" move is predictable, but traders still get trapped.

I called BS on this immediately and announced 5850 as the low hours ahead. Results?

One Level & One Level Only!

And if you were snoozing, our bot literally nailed the low in real time. Plus, shoutout to Usual Whale who took my advice from the last newsletter on using narrow call debit spreads in high vol environments, and absolutely printed as NQ bounced 400 points.

If you're surprised by any of this, you clearly haven't been paying attention.

My Exact Plan Moving Forward

This week, it's all about confirming the "Look Below and Fail." Market could still flip on a dime, so I'll adapt quick.

In terms of market structure, here’s what I’m looking at. Checkout the combined profiles from Mon-Wed last week, before the break out of balance:

See that tight little distribution? I want the market to hold here and chill out before ripping higher. If not? That's a clear rejection of prior balance, meaning the bears will be licking their chops.

My levels:

Pivot: 5935 (bottom of distribution)

Above pivot: targeting 5990, 6040, 6049

Below pivot: eyeing 5909, 5860, 5827

And since y’all loved our Quant Team's Market Maker Ranges, they're saying the market likely won't close above 6059 or below 5857. Sounds legit.

By the way — if you want my chartbook to visualize the market structure and see important levels clearly — it’s available for free in the Discord.

Want More of My Analysis?

Ready to call highs and lows with surgical precision instead of blindly YOLOing trades? Stop half-assing your trading and level up with Premium.

Live trading on voice: Hear me read the tape live — no hindsight BS.

Adam Set's Journal: Raw, unfiltered, pure alpha on every trade.

Order flow & volatility bots (and the new ETH Bot): Because manual scalping at 4 AM sucks.

Daily Plans: Know key reversals BEFORE they slap.

Educational resources: No fluff. Just actionable knowledge like DOM mastery.

We’re temporarily closed to new premium sign-ups to ensure everyone gets serious attention. Good news: our waitlist is open. Fill out a quick survey. We don’t care about your account size, just that you’re hungry and eager to crush it.

Please make sure your responses are thoughtful. If you pass our vibe check, we'll hit you up when a spot opens. Link stays active for 48 hours, so stay alert.

Can’t Wait?

If you’re itching for at least some alpha, hop into our free Discord. You’ll get Adam’s Chartbook, a risk management guide, and occasional real-time insights. Every so often, I’ll even drop a live call if I’m feeling generous—just don’t expect the full sauce for free.

Any questions? Hit reply. Unlike other guys who ghost, I actually answer and enjoy talking shop.

Catch you next week,

Jay