- TradeWithTitans Newsletter

- Posts

- TWT 2024 Year in Review

TWT 2024 Year in Review

The wins, the losses, and everything in between

Traders,

When I launched Trade With Titans (TWT) almost a year ago, the goal was simple: to pass on my order flow expertise and save retail traders from the painful mistakes I made early in my career. What’s happened since then has blown me away.

In 11 months, the community grew far beyond my expectations. More importantly, many of you became profitable, independent traders. Watching members not only succeed but also stick around to mentor the next wave of traders has been the highlight of my year.

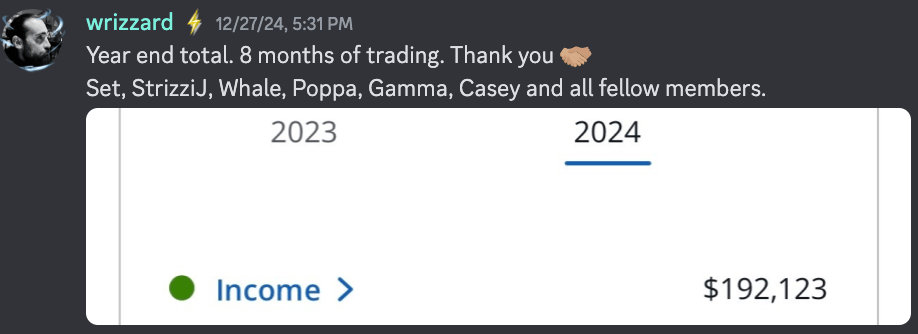

I’ve shared member success stories before, and I’ll continue doing so. But as they say, a picture is worth 1,000 words. So here’s just one:

One of our members had a life changing year

What would you do with an extra $190k?

How We Approached 2024

Before I get into the nitty gritty, I wanted to share some context about how we approached the year.

TWT launched with a solid foundation of educational content. So in 2024, our priority was to built on it by introducing automation to help members trade smarter, not harder. Here are the highlights:

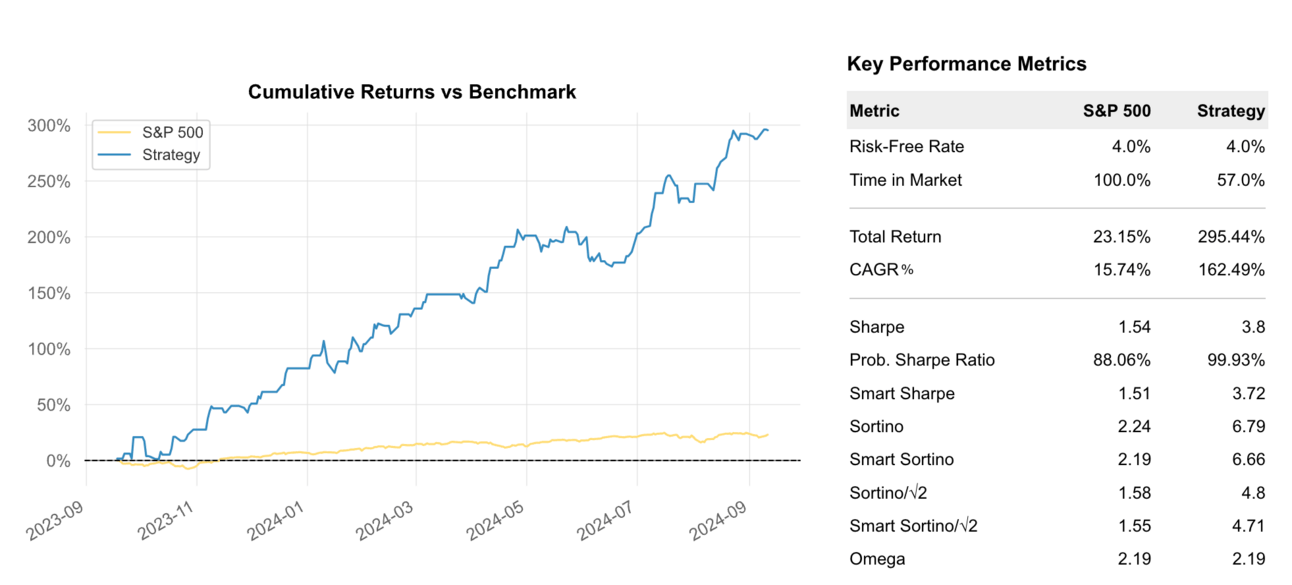

Order Flow Bot v3.5 (ES & NQ): Still processing the final 2024 results, but the Q1-Q3 performance speaks for itself.

Vol Bot (ES, NQ, CL): A game-changer for spotting reversals using options volatility. Now available on TradingView.

Daily Plan: Levels for both index futures and stocks.

ETH Bot (ES & NQ): Perfect for overnight session traders.

Orderflow Bot results through Q3 2024

Of course, we didn’t abandon our bread and butter: live trading on voice and swing trading updates in our journals.

2024 was a unique trading year. The market mostly went up, reducing the number of trading opportunities. But we made it work, capitalizing on strategic swings and intraday reversals. Hindsight makes it look easy, but remember — at the start of the year, we were just breaking all-time highs with plenty of uncertainty.

The Year’s Highlights

Instead of rehashing all 252 trading days, I’ll focus on the biggest wins and losses from TWT’s core team:

Jay & The Quant Team: My personal highlights and facepalms.

Adam Set’s Journal: When you’re as good as Set, you get your own section.

Casey’s Corner: Like WallStreetBets, but with actual math.

Free Stocks: How our free newsletter stock picks did!

If you’re short on time, here’s the high-level recap:

TWT’s 2024 Trading Summary

Jay & The Quant Team

April: A Humble Start

Mid-April brought our first real swing opportunity as the market began to sell off. I publicly called the low on Twitter—but I was two days early and got stopped out.

Could I spin this as a win? Sure. The April lows weren’t revisited all year. But I’m my harshest critic, so I’ll take the L.

Thinking this dip into 5030-5070 is going to be the dip everyone wishes they bought in a few months.

Shooting my shot

Gl hf

— Jay 'PoutinePapi' Strizz (@StrizziJ)

6:15 PM • Apr 17, 2024

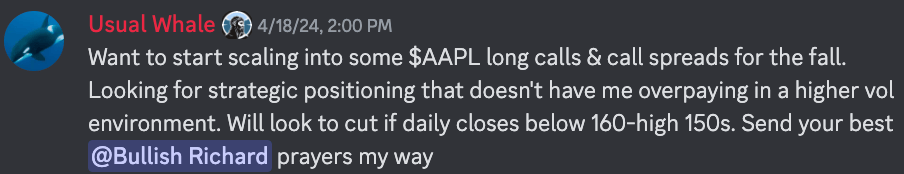

Thankfully, Usual Whale spotted a better opportunity in $AAPL. Watching order flow, he identified $165 as a key level for long exposure, opting for naked calls and call spreads.

Whale nailed an incredible $AAPL trade.

The result? A 55% rally in share price and massive gains for the options.

$AAPL ran and never looked back.

May: A Cleaner Swing

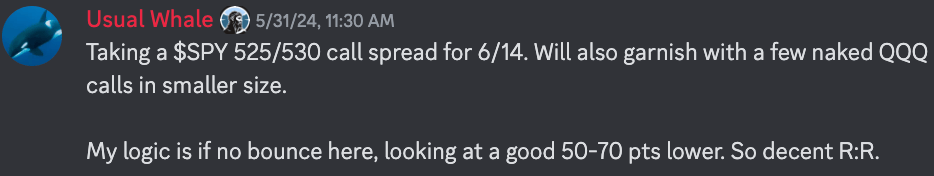

The end of May brought another buy-the-dip opportunity. Whale and I shared $SPY and $QQQ calls on May 31, right at the low.

We entered at the 5/31 lows using options.

From there, ES rallied 5205 to 5720, and NQ ran 18240 to 20980.

$QQQ put in a swing low at our entry. The option gains were even sweeter.

July: A Month of Pain

Let’s call July what it was: a rough month for me.

July 2: I called for an imminent sell-off. Once again I was a hair early, as the market rallied for 150 points before dropping 600 points.

Sell your stocks. Sell your house. Sell your cars. Sell your wife. Your kids. Your family.

Buy it all back at a 5-10% discount in a month.

Or enjoy your new wealth and upgrade across the board.

— Jay 'PoutinePapi' Strizz (@StrizziJ)

3:16 PM • Jul 2, 2024

July 18: Tried to buy the dip in the Discord. Unfortunately the market had other plans.

July 25: My redemption arc. I adjusted my bias and called for another 2-3% down. This time, I nailed it, as the market sold another 2.9% before putting in the swing low. Redemption!

Remember guys the "men" are buying this dip cause they're not sure if "53xx" comes.

Dip gets dippier. Month end below 5350 another 2-3% down ez clap.

— Jay 'PoutinePapi' Strizz (@StrizziJ)

2:05 PM • Jul 25, 2024

Was July tough? Yes. But as you’ll see later, Adam Set and others more than made up for it.

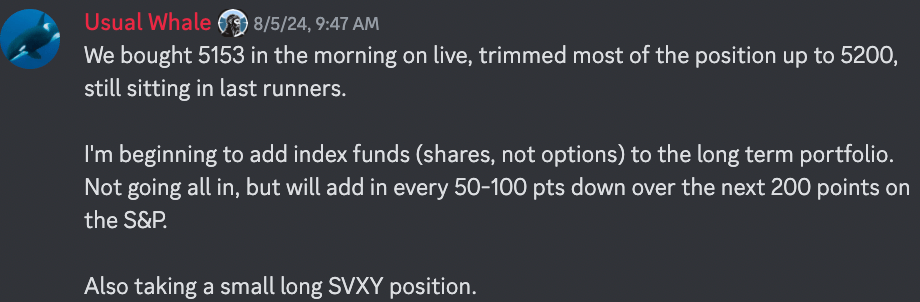

August: The Comeback

Things finally got really interesting in August, as the Bank of Japan struck fear into the souls of carry traders, causing the VIX to finally be able to collect a social security check.

We wasted no time buying the August swing lows.

The quant team sprang into action, buying ES at 5153 — the low for the rest of the year — on August 5. They also shorted volatility via $SVXY, which returned 40% in two weeks.

ES rallied over 1000 points off this entry.

$SVXY returned 40% in just 2 weeks (shares only)!

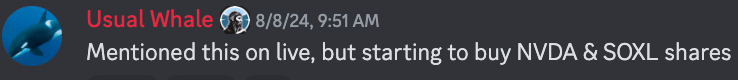

Later, they added $NVDA at $98 and $SOXL at $26 during the August 8 retest.

We caught incredible entries on $NVDA and $SOXL

These trades printed 30% and 60% gains with shares alone.

Our $NVDA long was just too good.

After those incredible dip buys, the rest of the year was just gravy as we watched those positions print. With some excellent intraday live trading by yours truly, the profits rolled in.

Adam Set: The Oracle

Adam Set may be the world’s most generous man. Since he already gives away a ton of his content for free, you’re probably already aware of his prophetic ability to grasp the pulse of the market. Nevertheless, keep reading, because he makes sure to save the crème de la crème for TWT.

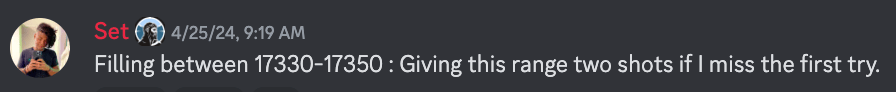

April

Although I fumbled the April low, Set cleverly waited for a bit more confirmation. On April 25, he longed NQ at 17330, reloading on May 1 at 17440.

Set more than made up for my blunder.

You don’t even need a chart to know how this one turned out.

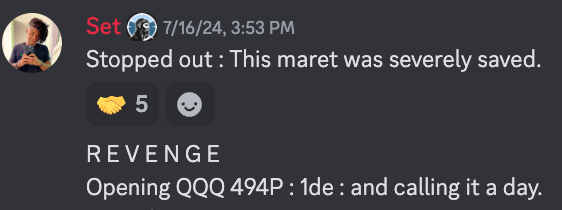

July

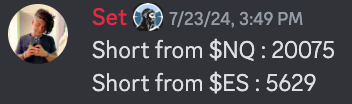

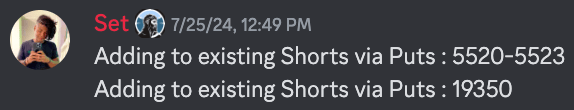

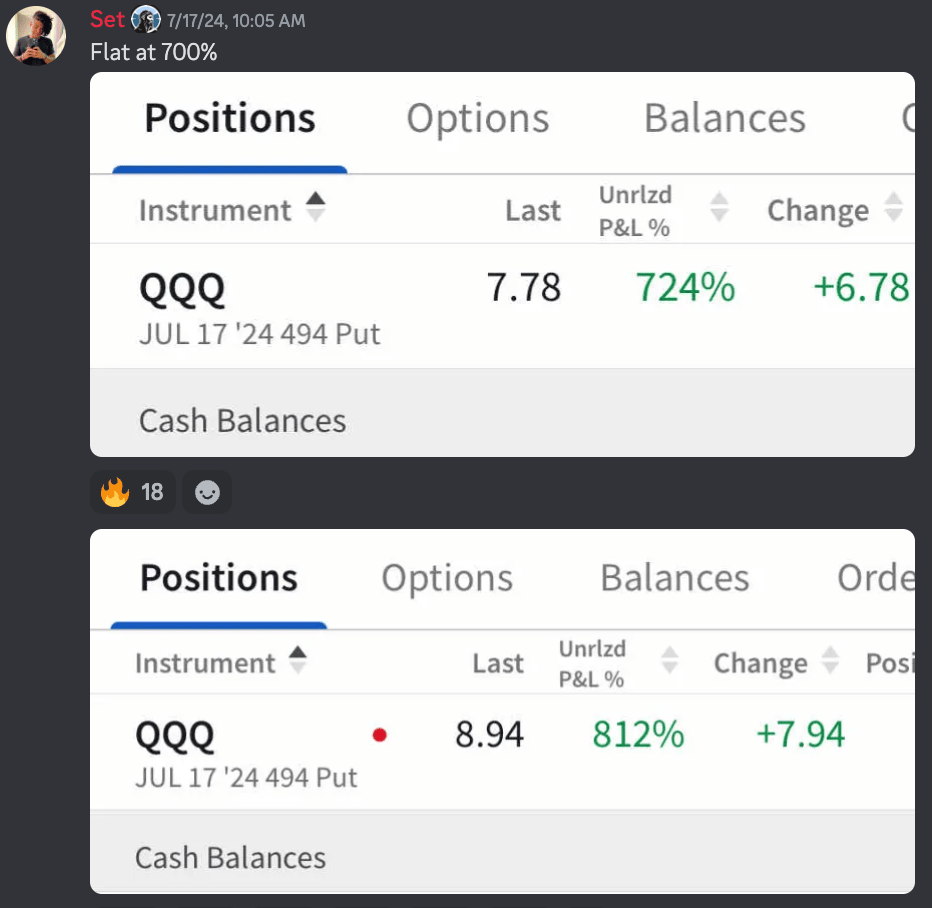

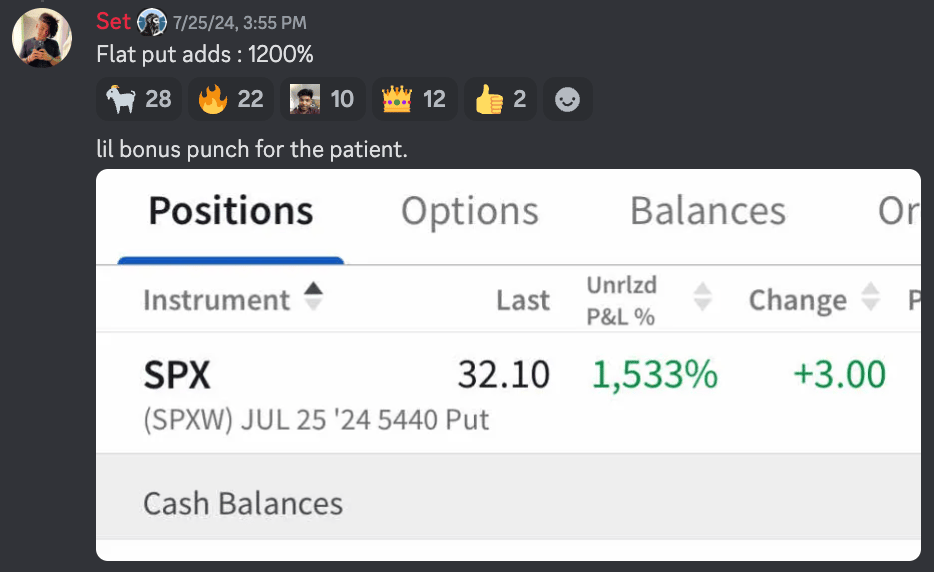

Set absolutely crushed July’s downtrend:

Shorted via puts on July 16.

Set had a great put entry as the July sell began.

Shorted NQ on July 23.

Set shorted again at a great location.

Doubled down with puts on July 25.

He even added again a few days later!

The results? NQ dropped 2700 points, and his put positions returned 800% and 1500%.

800% in just 1 day!

I guess 800% wasn’t good enough!

July was a shorting masterclass by Set!

September

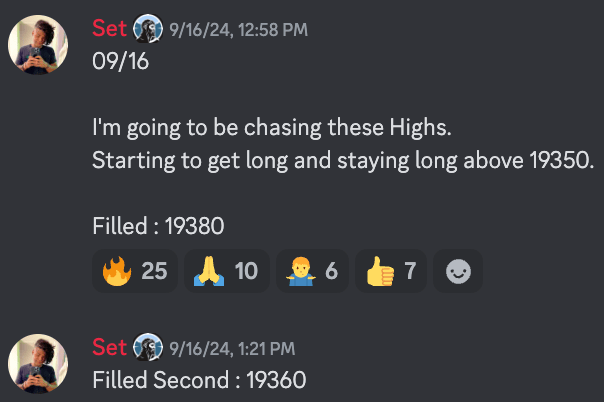

September was a simple month for Set. He wasn’t in a hurry to jump into any trades after absolutely printing in the prior few months, so he patiently waited to hop on the long trend. Eventually, he found his entry on NQ around 19360.

Set patiently waited for a solid entry.

The chart speaks for itself.

Set caught another amazing NQ long in September.

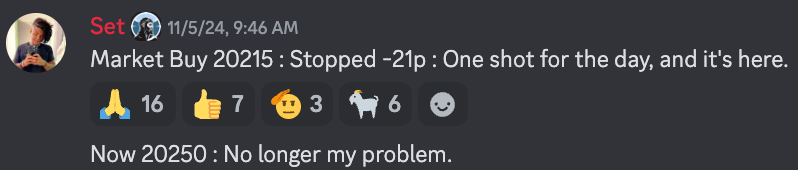

November

You didn’t think Set would miss the year-end push, did you? On November 5, he longed NQ at 20215, adding again on November 18 at 20530.

Set foresaw the year end leg up.

A big NQ rally followed Set’s long entry.

There’s no sugar coating it. Adam Set is a bad man.

Casey’s Corner

We’ve spoken about how Casey’s brilliant tools allow him to detect unusual options flow with a level of precision unmatched by anything else out there. Thankfully we’re lucky to have this man in our corner, as he gave us some of the best options trades of the year. Here’s a few recent ones I wanted to highlight:

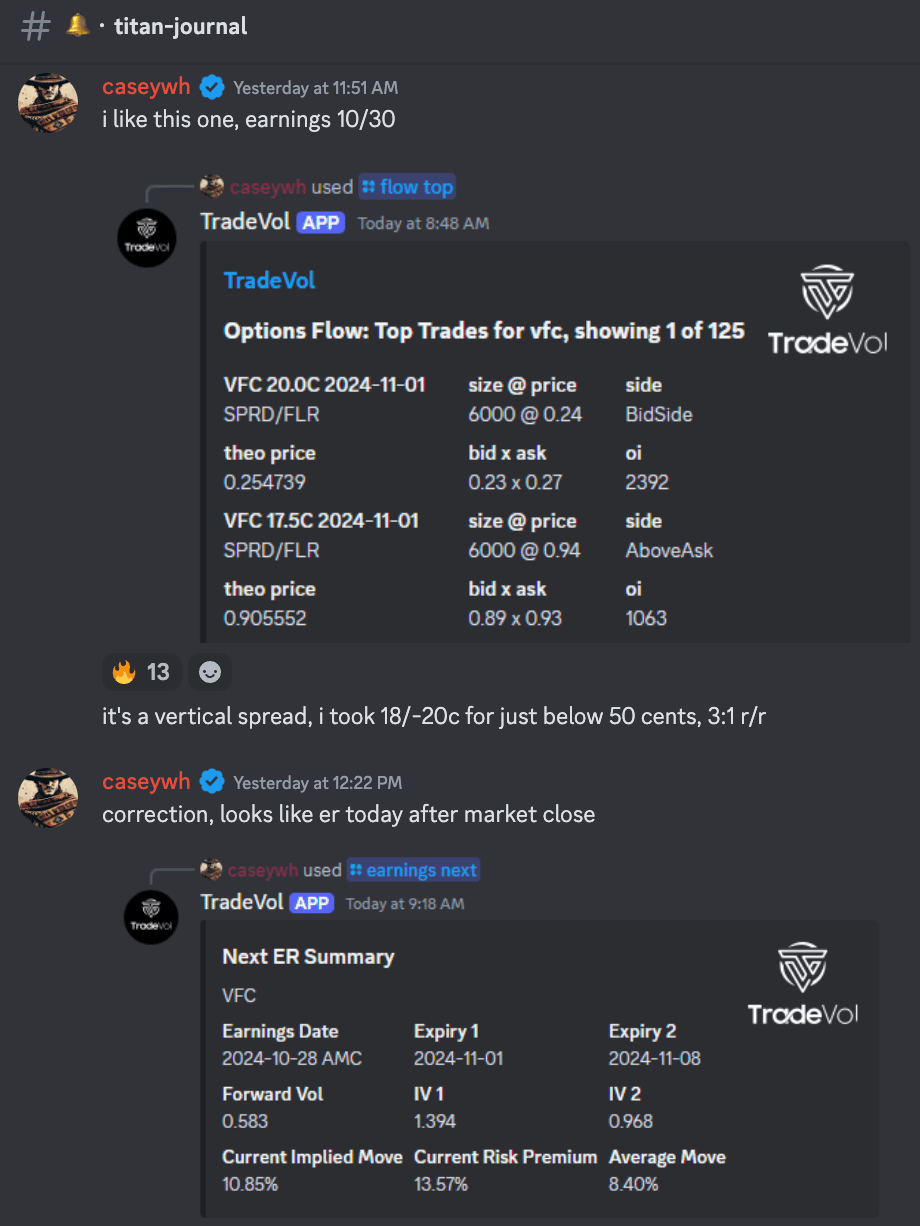

$VFC

Casey caught some bullish $VFC flow just before earnings:

Casey cleverly caught some bullish $VFC flow using his tools.

Surely enough, the price skyrocketed after the report:

$VFC mooned right at close.

And we banked accordingly:

$VFC was a multi-bagger for our members!

If you want the full breakdown with all the math and numbers, you can read about it here.

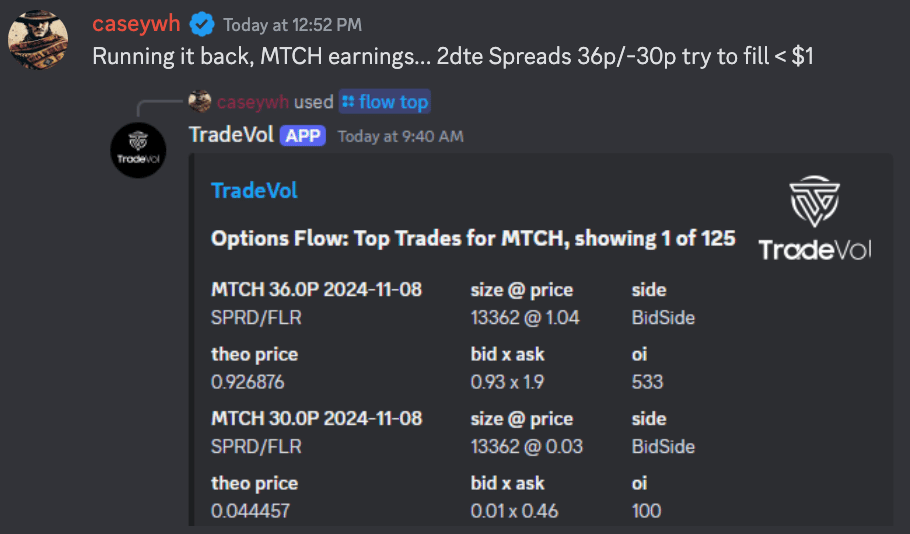

$MTCH

Once again, Casey caught some unusual options flow on $MTCH before earnings:

Casey spotted bearish flow on $MTCH.

Of course, most traders would see both legs filled at the bid and think it was a bullish trade. But thanks to some clever math using the implied volatility surface, Casey is able to get the “theo price” you see in the alert, indicating it was actually very bearish positioning.

The result? Utter destruction.

$MTCH tanked after a poor earnings result.

For the full scoop, check out our previous coverage of the trade here.

Free Stock Picks

Every single one these trades was given completely free. What’s your excuse?

$NVDA

The same trade we shared in TWT, given for free. You know the result.

I shared Whale and Ven’s NVDA long thesis last Thursday and since Friday it’s up 8%

Told you the tape has flipped bullish and since Friday ES it’s up 100 points

If you’re not reading our free newsletter I don’t know what to tell ya 🤷♂️

— Jay 'PoutinePapi' Strizz (@StrizziJ)

4:46 PM • Aug 13, 2024

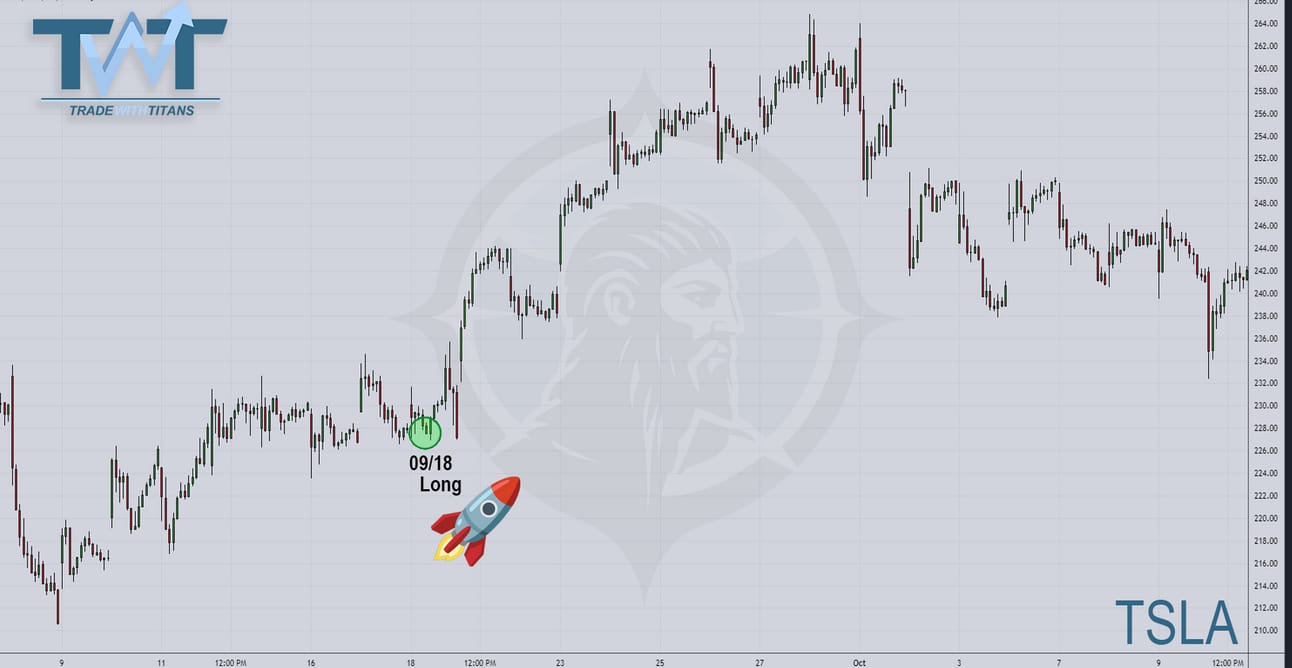

$TSLA

We covered this bad boy in our September 18th newsletter. Not only did this one hit our 10+% initial price target rather quickly, but those who held on a bit longer saw their shares more than double in value in just 1 quarter. Incredible.

$TSLA went on an absolute tear in Q4.

$ORLY

I still haven’t gotten that stupid jingle out of my head. But this guy saw a monster rally on very little drawdown following our September 25th newsletter call out.

A near perfect entry on $ORLY in the newsletter.

$TDS

Here’s another one we nailed thanks to some unusual options flow. $TDS smashed through our initial price target quickly and went onto return over 50% in less than 3 months!

$TDS more than delivered on our expectations.

$XOM

Don’t worry, we’re not perfect. We saw support building here back in October, but that’s life when you’re playing in the energy space. Nonetheless, I actually think we could have an even better buying opportunity in 2025, but let’s wait and see.

Unfortunately $XOM didn’t quite work out as well as the others.

Takeaways

The value from retrospectives like these isn’t in the summary, it’s in the takeaways. Here’s the biggest lessons I learned that I want to carry onto 2025:

Confirmation matters. Our best trades often came after some confirmation, especially on the short side where timing has been tricky. Moving forward, I’ll look to take more trades off retests or after I see more evidence of a local low/high forming.

Sometimes, less is more. Just sitting long from dips had amazing results.

Automation is key. The Orderflow Bot, Vol Bot, and Daily Plan are now staples.

There’s more out there. If we are hungry for more, there’s still lots of other avenues to explore. For example, we only scratched the surface with analyzing single stock options flow.

Don’t over fit on the past! Past performance is not indicative of future results. 2025 may bring a more volatile market. We have to be mentally ready to adapt.

Looking Forward

Speaking of next year, here are some of our future plans for TWT:

More Automation: Look out for Bot 4.0, and live transcriptions from our morning voice sessions!

TradingView & Sierra Charts: We’ll be bringing our more of our tools to these platforms.

Education: Much more education to come: including topics like “How to Derive Levels” and “Risk Management”.

Want To Join?

It’s not too late to sign up and take advantage of our holiday special!

Use the code “HOLIDAY” (no quotes) for 30% off your first month, quarter, or year!

Not convinced? There’s a 7-day money back guarantee, so give it a shot, no risk!

Jokes aside, whether you’re a TWT member or follower of my work, it’s been my pleasure to partake in this crazy journey with all of you. I hope you found this helpful. Here’s to an even better 2025!

Jay